SPY: Potential, Yes, But Risks Ahead Too (SP500)

[ad_1]

tadamichi

The S&P 500 (SP500) has done quite well in the first quarter of 2024 (Q1 2024), up by 9.7% at the time of writing. By extension, its replica fund, the SPDR S&P 500 ETF Trust (NYSEARCA:SPY) is also ahead. There are two reasons why this trend is particularly interesting:

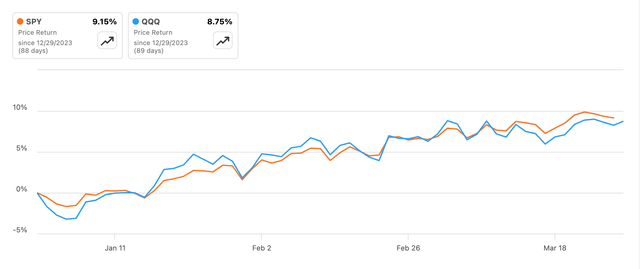

- The rise slightly outstrips the Nasdaq tracker fund Invesco QQQ Trust ETF (QQQ) so far this year. This is a turn in trend from last year when QQQ saw an increase of 54% compared with 24% for SPY. The SPY’s lead is trivial at present (see chart below) but at the very least it indicates that it has caught up with QQQ.

- The rise is even more significant considering that it comes at a time when the US economy is expected to see a slowdown, even as inflation cools off and interest rates are expected to start coming off later in the year. In fact, my projections for the S&P 500 indicated that on average, the figure would be 0.75% below the average number of 2023 based on the index’s relationship with US GDP.

Price Returns, YTD (Source: Seeking Alpha)

Why SPY continues to rise

This raises the question as to why SPY continues to inch up, especially as this isn’t just a point-to-point increase. The average increase in SPY in Q1 2024 is at 16.3% compared to the full-year average for 2023, which is even higher than the period-end increase of 9.2%.

In other words, the increase is a far more consistent increase than would be suggested by an end-of-period comparison. This is explained by the performance and potential of its top 10 holdings as well as a supportive macroeconomic context.

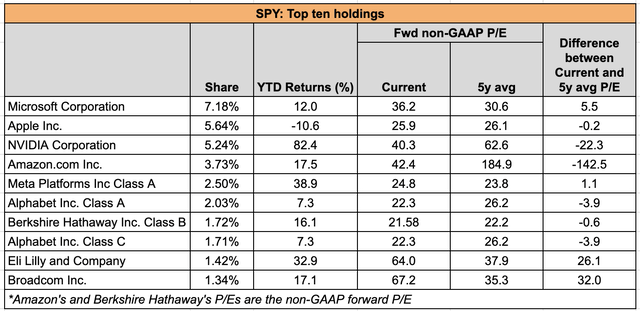

Continued strong performance by top holdings

A look at the trust’s top 10 holdings reveals that they have seen an even bigger YTD weighted average increase of 23%, driven significantly by NVIDIA (NVDA) (see table below). Further, save Apple (AAPL) all of them have continued to rise YTD. Pharmaceuticals biggie Eli Lilly (LLY) and Broadcom (AVGO) are particularly notable in this regard, with double-digit increases even though they are trading much higher than their five-year average forward GAAP price-to-earnings (P/E) ratios. In fact, the superior performance of LLY and Berkshire Hathaway (BRK.B) explains the small edge SPY has over QQQ at present.

Source: Seeking Alpha, Author’s Estimates

Further, six of the ten holdings are now trading below their five-year averages to varying degrees. Amazon (AMZN) which is trading at the lowest relative valuation has an upside even based on a deeper fundamental analysis.

The potential of these holdings can explain why SPY has risen so far in 2024 and why it can rise going forward as well. This upside might even temper the downside to the stocks that currently far exceed their five-year averages. It does need to be said though, that even the ones that look overvalued right now, are rated as Buy by both Seeking Alpha and Wall Street analysts.

What the macroeconomic prospects say

The macros have also supported SPY’s growth in Q1 2024. The US economy continued to see above-trend growth of 3.2% in Q4 2023. Moreover, the full-year 2024 forecast has been upped to 2.4% from the earlier 1.7%. This is the difference between above-trend and below-trend growth, which is saying something. I’ve written about the economy more in detail in my recent article on QQQ, so I won’t go over it again.

But here I do want to tie this discussion back to the regression analysis I did the last time for SP500, with GDP as the explanatory variable. As it turns out, compared to the 0.75% decline forecast the last time from this analysis, an input of 2.4% growth in 2024 indicates that the SP500 on average will remain basically the same as in 2023. This in turn means that even if the SP500 were to drop to an average level of around 4,050 for the remainder of the year from the current level of 5,203, it would still come out at the same levels as last year.

The risks to SP500

The question now is, is the index likely to fall that much in the year? Or at all, for that matter? There are certainly risks of a decline. Its current P/E is at 28.3x, which is higher than the past 10-year average ratio of 24.7x. If the ratio were to decline to its average level this year, the SP500 would drop by 13% from the current levels to 4,552.

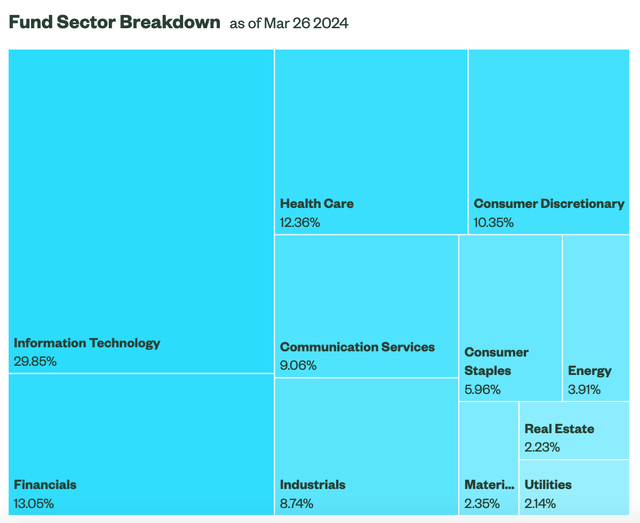

This is possible if the economy weakens from hereon, which can’t be ruled out. Going back to the forecasts for the US economy, growth is expected to be between 1.5-1.7% in the next three quarters, which is underwhelming. This can impact the index and the fund, 30% of whose holdings are in macro-sensitive sectors like financials, industrials, real estate, energy and materials (see chart below).

Source: State Street

That said, there can be some support from softening inflation and later in the year, lower interest rates. However, the combination of how these various macro indicators play out can be crucial in determining what’s next for the S&P 500.

What next?

In sum, while there’s an upside to SPY, there are also risks ahead. The continued momentum is impressive, reflecting investor confidence. Its top 10 holdings also give reason for optimism, with six of them trading below their five-year average P/E.

But a potential slowing down of the economy is a key risk to consider, still. Even if GDP growth is relatively healthy in the US this year, my analysis indicates that there’s little upside to the index from 2023. This in turn means that the fund price can decline from current levels. Even if it doesn’t decline as much as indicated by the analysis, there would still be a fair correction if its P/E were to fall to the historical average.

Considering how much it has risen already in the past year and so far in 2024, this isn’t the time to take risks with the index for short-term investing. For this reason, I’m retaining the Hold rating.

[ad_2]

Read More: SPY: Potential, Yes, But Risks Ahead Too (SP500)