SDS: Geopolitical Uncertainity Driving This Higher (Technical Analysis) (NYSEARCA:SDS)

[ad_1]

fotofrog

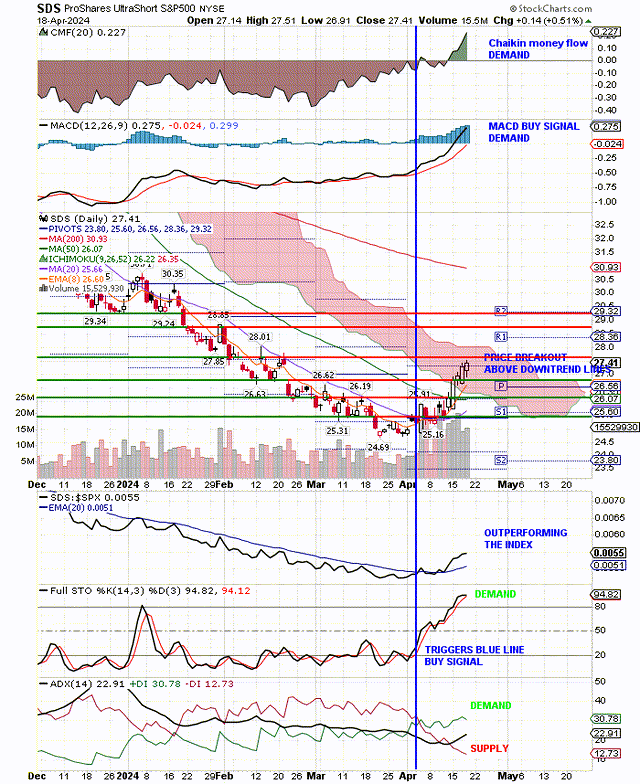

Our Model Portfolio went to cash because of the market, as represented by SPDR® S&P 500 ETF Trust (SPY), Sell Signals. Now we have put some of that cash to work in an inverse ETF that goes up when the SPY goes down. We are allocating $50,000 of our $100,000 portfolio to the -2x leveraged ProShares UltraShort S&P500 ETF (NYSEARCA:SDS) which is now outperforming the Index. (We did this the last time the market turned down on January 3rd at $30.86. We closed that position at $30.41 for a 45 cent loss per share on 1,621 shares.)

Our thesis, short term, is that the SPY will continue lower to $490 next and possibly $480. This all depends on Israel’s attack on Iran and Iran’s threatened response. As background, we don’t expect the Fed to drop rates anytime soon. The U.S. is spending on the wars in Ukraine and Israel, and that is inflationary and will contribute to a strong economy.

We expect good April earnings reports to continue and the innovation wave of Artificial Intelligence, or AI, to continue to drive the market. That is already priced into the market. What is not priced in is a war in the Middle East. The market does not expect that to happen. However, the uncertainty of the next move by Iran is taking the market down until it happens. The market continues to go lower because of this uncertainty. As soon as this is removed, the market will bounce back because of the good earnings and AI driving earnings higher and creating new growth.

We think the market goes lower short term. When the Middle East crisis is over, we look for a bounce. However, even if the crisis is over, and we have a bounce, we still look for weakness starting in August and extending into October because of high interest rates. The worst 6 months in the market starts in May, so if the Middle East war does not continue to take us down, the seasonal weakness probably will.

If the Middle East is not resolved short term, then we think the downtrend that has started will continue into October. The market is overbought and overvalued, and may just be using the Middle East war as an excuse to correct excesses in the market.

We think that our expenditures for the wars in Ukraine and Israel will continue to stimulate the economy and prevent the Fed from dropping rates. That will put a drag on certain sectors of the economy, as the stimulus provides a soft landing for the economy.

Of course, if the Middle East blows up then all bets are off, except we will add to our existing SDS position. If the Middle East is resolved, we will close our SDS position and add stocks to our Model Portfolio.

Even during a bear market move, we always have a list of stocks that have our proprietary SID buy signal. We send this daily list out to our subscribers, especially young investors who are long-term buy and hold investors. Retired investors cannot afford to be caught in a bear market, but younger investors can always wait it out and ride the AI wave of innovation for the next 20 years.

Here is the SDS daily chart, and you can see the reversal breakout in price as it moves above the short-term downtrends and starts outperforming the Index. You can also see other Buy signals such as our vertical, blue line Buy Signal triggered by the Full Stochastic signal. The other signals are showing increasing Demand.

Please review the risks of leveraged ETFs here before making any investments, and remember that the daily -2X leverage factor is a source of drift, which means SDS may lose value just due to daily volatility. Leveraged ETFs are best used only for short-term trades by experienced investors.

SDS buy signals and outperforming the Index so adding to our model portfolio (stockcharts.com)

[ad_2]

Read More: SDS: Geopolitical Uncertainity Driving This Higher (Technical Analysis) (NYSEARCA:SDS)