Some country-themed ETFs are outrunning SPY ETF in 3Y returns – Bespoke

[ad_1]

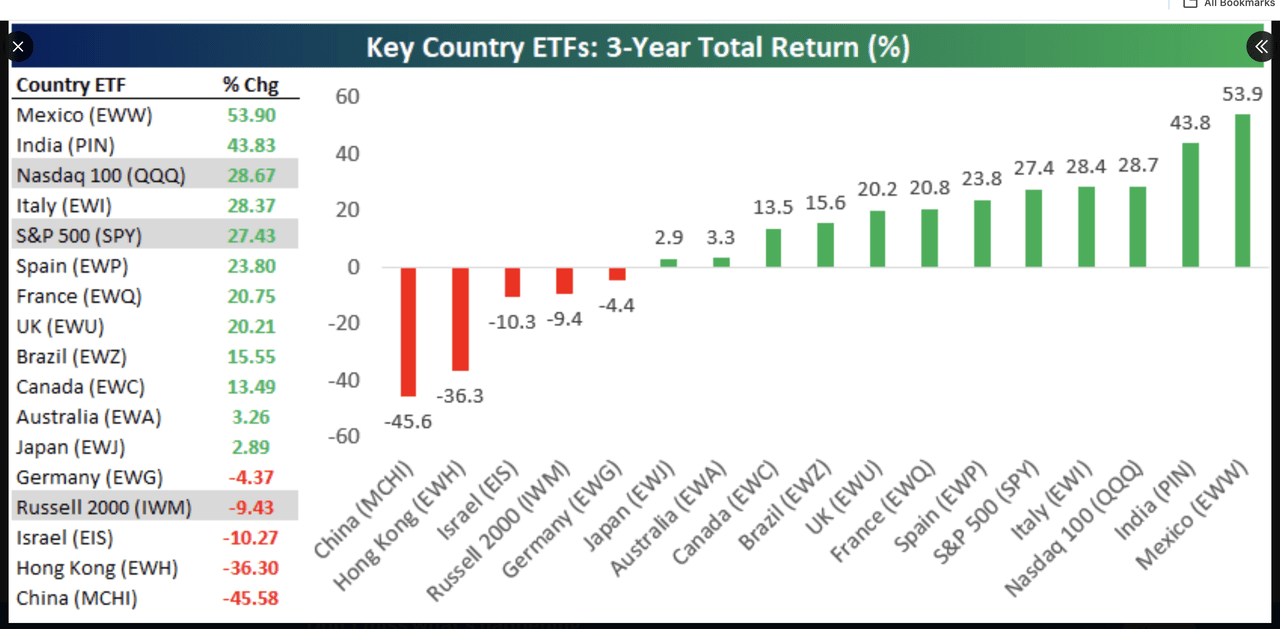

The popular SPDR S&P 500 ETF (SPY) tracking U.S. large-cap stocks has notched a double-digit return in a multi-year run but there are some country-themed exchange-traded funds that have generated bigger returns.

Bespoke Investment Group, in a post on X (formerly Twitter), highlighted country ETFs that are in-line or a few percentage points above and below the S&P 500 (SP500) as well as the Invesco QQQ Trust Series 1 (QQQ) that tracks the tech-concentrated Nasdaq-100 (NDX) when looking at three-year returns. SPY has returned ~27% and QQQ has returned ~ 28%.

“Mexico (EWW) has been the biggest winner,” with a return of ~54%,” Bespoke said, referring to the iShares MSCI Mexico ETF.

Seeking Alpha contributor GV Strategies said earlier in April that Mexican stocks have been a “good place to be” over the last few years after overcoming a low returning decade like other emerging markets. A nearshoring theme and supply chains moving out of China have helped bolster the market, GV Strategies said.

Other big winners are the Invesco India ETF (PIN) by returning ~44% and iShares MSCI Italy ETF (EWI) by raking in +28%, Bespoke said.

But the performance for U.S. small caps has been less impressive, with the iShares Russell 2000 ETF (IWM) down +9% on a 3-year total return basis.

Alistair Berg

[ad_2]

Read More: Some country-themed ETFs are outrunning SPY ETF in 3Y returns – Bespoke