S&P 500: Time To Hedge, Here’s How (NYSEARCA:SPY)

[ad_1]

asbe

Dear readers,

I’ve written a number of articles on the S&P 500 (NYSEARCA:SPY) to share my outlook for the market. Most recently, I wrote an article mid-January, when the S&P 500 stood at 4,760 points, and issued a HOLD rating. I explained why I was bullish on the index in the short term and was expecting new all-time highs. Moreover, I went over the reasons why I wasn’t particularly thrilled about the longer-term prospects of the index due to a stretched valuation.

The first part of my thesis has materialized as the index did indeed reach new all-time highs and now stands at 5,150 points. But since the risks that lead me to be cautious over the longer term are still very much present, I started hedging my position aggressively. Today I provide an updated thesis on the index, present the key risks that I’m looking at and present an option hedging strategy which I’m actively using to hedge the potential downside.

Where we are

Just recently, the S&P 500 hit a fresh new all-time high of 5,150 points.

As great as that is, it also means that the valuation has got even more stretched. Earnings per share are expected at $246 in 2024, up double digits from last year, which puts the forward P/E multiple at nearly 21x, much above historical averages.

Risks

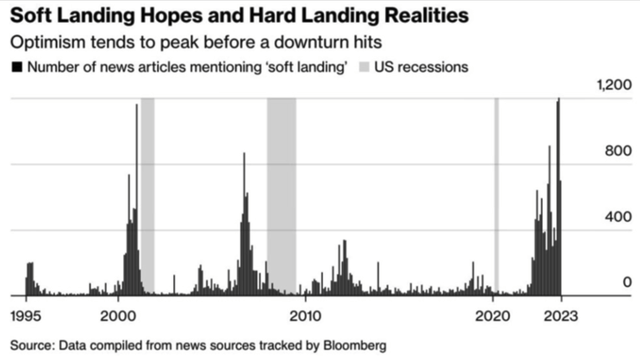

None of us know what the future holds and while the economy remains strong and there are no indications of things going bad, it’s worth remembering that optimism always tends to peak right before something breaks.

Bloomberg

In particular, I see three potential risks that would most definitely send the markets (much) lower. In the order of a potential negative impact, these are:

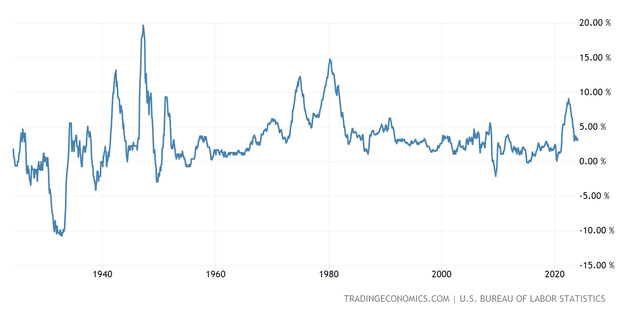

1 – Reaccelerating inflation

If you look at the chart below, inflation rarely stabilized after the first surge. More often than not, the first wave of inflation was followed by a second (larger) wave of rising prices. See 1950 and 1980 below. So far, there is no data pointing to inflation reigniting, quite the opposite, but it’s worth keeping this possibility in mind as it would be totally devastating to the market.

Chart: CPI in the United States

Trading economics

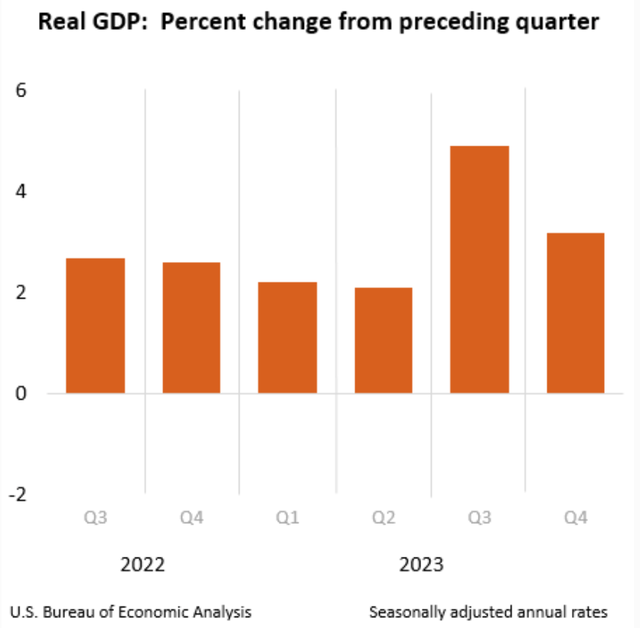

2 – A recession

Many have been predicting a recession for over a year, and clearly it hasn’t materialized as GDP growth remains strong and even above the Fed’s 2% target. Most recently, GDP in Q4 stood at 3.2%. But once again, it’s worth keeping this risk in mind as the yield curve remains inverted and, based on historical timing, suggests a start of a recession around May of this year. A recession would likely lead to bigger than expected rate cuts by the Fed, but I expect that it would be a net negative for the S&P 500, though with significantly lower downside than the risk of accelerating inflation.

U.S. Bureau of Economic Analysis

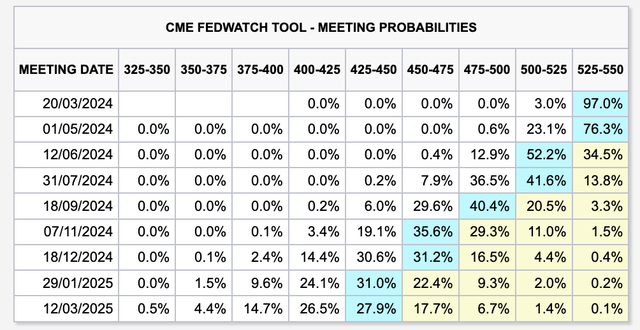

3 – A Fed that’s reluctant to cut rates

Finally, the least threatening and most likely risk is that the Fed sticks to the current rate for longer to make sure that it has tamed inflation for good and that it won’t reaccelerate upon monetary policy easing like it did in 1950 and 1980.

Currently, trading implies a 23% probability of the first rate cut in May and a 65% probability of at least one cut by June. Frankly, I don’t think it matters much if the Fed cuts a couple months later. And as long as we avoid the first two risks, there should be little that stands in the way of the S&P 500 price moving higher in the coming months.

CME FedWatch Tool

My hedging strategy

Because I’m bullish in the short term, I want to stay invested and keep exposure to the index. But at the same time, because I’m not quite comfortable with the valuation and see several potential risks that could result in a significant sell-off, I want to hedge my position to protect against the downside.

In doing so, I currently prefer to use zero cost option collars.

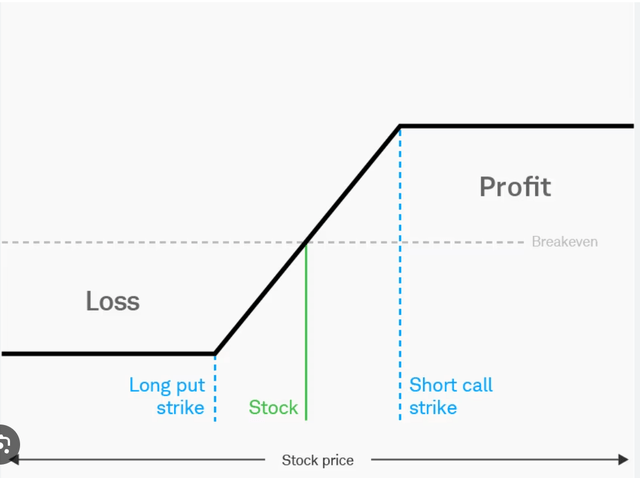

The strategy involves hedging a stock position (in this case SPY or a similar S&P 500 derivative) with a put option at a strike price below the stock price to limit the downside. Then, to fund the put premium, we sell a call option with a strike price above the current price. In doing so, we give up the potential upside above a certain price, but get paid a premium which should offset the put premium and make the hedge zero-cost.

Charles Schwab

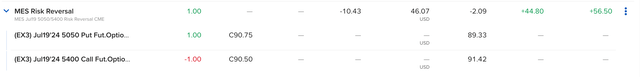

Personally, I own zero cost option collars that expire in mid-July of this year. Note that there are a number of option contracts to choose from depending on your broker and position size. Most options are sold in multiples of 100, meaning that 1 option contract on SPY corresponds to roughly a $50,000 hedge. If that’s too big a hedge for you, one alternative can be options on futures such as MES – Micro E-Mini S&P500 Futures where option contracts are sold in multiples of $5 meaning that 1 option contract corresponds to roughly a $25,000 hedge. Due to my broker limitations which prevent me from buying options on SPY, options on MES are my preferred way of hedging my S&P 500 exposure.

Just yesterday I increased my hedge to roughly 50% of my position via a:

- LONG July 19th PUT with a 5,050 strike price at a $89.33 premium

- SHORT July 19th CALL with a 5,400 strike price at a $91.42 premium

Author’s IBKR account

Since the call premium was slightly higher than the put premium, I got paid about $2 to enter position, even better than zero-cost. Now $25,000 of my exposure is protected against downside below 5,050 points, capping my downside at roughly 2%. My upside is capped at 5,400 points, leaving around 5% appreciation potential between now and mid-July.

Note that the best time to use this strategy is in a bullish trend with high volatility, because then the call is most expensive and we receive a large premium for shorting it. All in all I really like the risk-reward of the strategy at this time.

I rate SPY a HOLD here with the caveat that it is not a bad time to hedge at least some exposure.

[ad_2]

Read More: S&P 500: Time To Hedge, Here’s How (NYSEARCA:SPY)