SPY: 10 Reasons To Believe A 10% Decline In The S&P 500 Is Forthcoming

[ad_1]

jcrosemann

The SPDR® S&P 500 ETF Trust (NYSEARCA:SPY) rose 10.2% in the first quarter of this year, the best quarter it has had since 2019. However, the S&P 500 Index (SP500) has found the going much tougher here in the first half of April. I think this downward trend will continue, and the index will give up all the gains accrued in the first quarter when all is said and done. Here are ten reasons I think the markets are flashing “yellow” for the economy and equities.

Equities Haven’t Reflected The Recent Spike In Interest Rates Yet

The yield on the United States 10-Year Bond Yield (US10Y) has moved from just under 3.9% on February 1st to 4.65% as of Tuesday morning. That is a 20% spike in yields for those playing at home. Normally, this sort of sharp move would trigger a selloff in equities. However, the S&P 500 has actually moved up nearly five percent including dividends during this big pop in interest rates. I would look for some significant “reversion to the mean” trading action in the coming weeks to properly reflect the recent move in yields.

Ten-Year Treasury Yield (MarketWatch)

Yield Curve Remains Inverted

An inverted yield curve has always been a reliable sign of an encroaching recession. However, the Two- and Ten-Year Treasury yields have now been inverted for nearly 450 days. This is the longest duration ever recorded, and no recession has been forthcoming. I would attribute this somewhat to the massive amount of deficit spending being done by the federal government. This is not sustainable given the U.S. has the highest debt-to-GDP ratio in its history, however. The previous longest period of inversion recorded occurred from the summer of 1978 to early 1980, which was followed by a brutal recession. I think this reliable signal will call a recession correctly over the next 12 months.

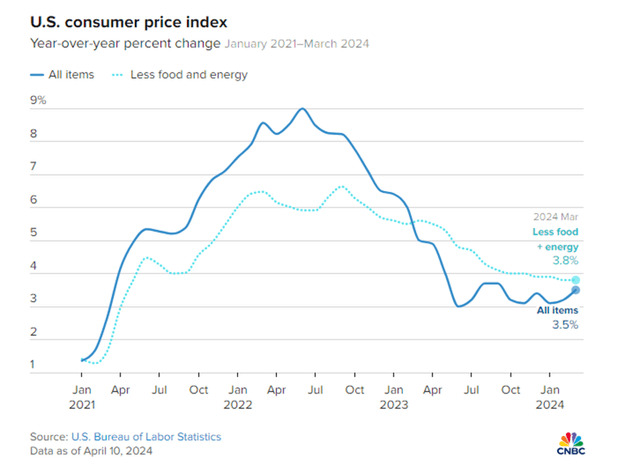

Inflation Isn’t Going Anywhere

After peaking in June 2022, inflation levels have moved down rapidly until recently. However, they bottomed early last summer, and inflation has been stubbornly “sticky” ever since. March CPI and PPI readings confirmed this continues to be the case. This is the key reason projections for Fed Fund rate cuts have continuously been moved back throughout 2024. Given the Federal Reserve increased the money supply by some 40% over two years during the pandemic and the federal government continues to run a massive deficit ($1.06T in the first six months of their fiscal 2024), inflation looks like it will remain “higher for longer” as will interest rates. Both will be headwinds for equities in the coming months.

Insiders Are Selling

The most recent Vickers Insiders Weekly Report had the insider sell/buy ratio at 6.43. A reading above 2.5 is deemed to be negative for the market. This is the highest sell/buy ratio recorded since late 2021, just before the NASDAQ Composite Index (COMP:IND) lost a third of its value in 2022 it should be noted.

Jobs Market Is Deteriorating

Headline BLS jobs report numbers continue to be strong. However, these reports come with caveats. First, eleven of the twelve monthly BLS jobs reports in 2023 were subsequently revised down. In addition, since March 2023, more than one million full-time jobs have been lost. This has been papered over in these reports by the huge surge in part-time jobs, as Americans are working a record amount of second and third jobs to make ends meet.

Zero Hedge

Consumers Are Tapped Out

The average American household has lost buying power against inflation since the beginning of 2021. In addition to taking second jobs, consumer spending was maintained through excess savings from the COVID-19 pandemic for several years. Lately, consumers have been increasingly using credit card debt to maintain living standards. A key reason that credit card balances are at record highs. Obviously, this is not sustainable and consumer delinquencies and defaults are likely to increase in coming quarters. The credit card delinquency rates just hit its worst level since 2012. Auto loan default delinquencies are already at their highest levels this century.

Yes, March retail sales climbed 0.7% month over month in March to $709.6 billion, much stronger than the .4% increase expected yesterday. However, retail sales rose 2.1% on a year-over-year basis in the first quarter, lower than the current rate of inflation in the proper context.

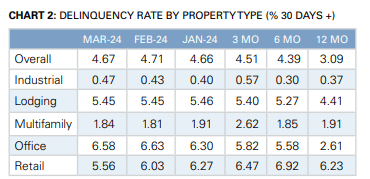

Commercial Real Estate Continues To Get Worse

March CMBS Delinquency Rate By CRE Asset Class (Trepp)

As I noted in a recent article, many parts of the commercial real estate space continue to deteriorate, especially office properties. As you can see above, the delinquency rate for Commercial Mortgage Back Securities or CMBS has risen by more than 50% over the past year for CRE overall. Delinquency rates for office properties have moved up to approximately 400 bps. More than $900 billion in CRE debt needs to be refinanced at much higher rates in 2024, so delinquency and default rates are destined to continue to rise as long as interest rates remain “higher for longer.” This will be a significant headwind to the banking system, especially regional banks, which have much more exposure to this sector than major money center banks like JPMorgan Chase & Co. (JPM).

Geopolitical Risks Are Increasing

The situation between Israel and Iran could easily spill into a wider regional conflict in the coming months. The Houthis in Yemen continue to attack Western shipping interests in the Red Sea, where just over 10% of global oil supplies go through. The situation in Ukraine also continues to deteriorate, with the chief of the Ukrainian army admitting the Russian armed forces are making “significant gains” on the Eastern Front this week. The president of Ukraine and most military pundits also expect a major offensive in the months ahead as well.

A 10% Pullback Would Be Normal

As was noted yesterday on Real Money Pro, The S&P 500 has only had a 2.5% peak-to-trough move so far in 2024. This would tie it with 1995 for the smallest ever. Pullbacks are part of even bull markets. Even 2023, which was a great year for investors, saw a just over 10% pullback from August to late October.

Ryan Detrick

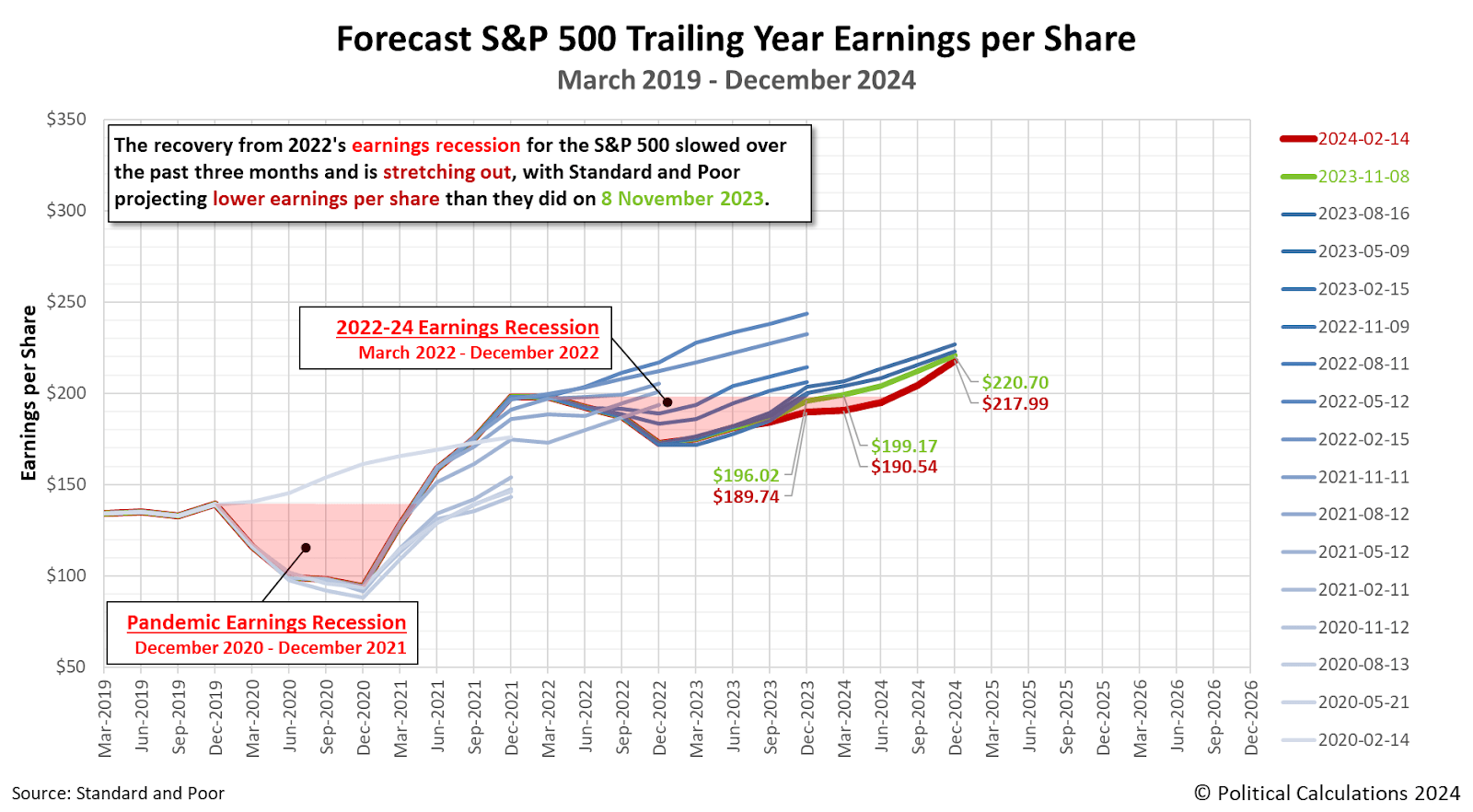

There Is Little Risk Premium In Equities

One of the first things an investor learns in Finance 101 is that individuals invest in stocks to earn a premium over risk-free instruments over time. A recent article noted that S&P 500 earnings projections. The inverse earnings yield from those projections is just under 4.5% or less than the “risk-free” yield on the 10-Year Treasury currently.

Standard & Poors

Conclusion:

Given these economic factors and readings, I continue to be bearish on the overall market and expect at least a 10% decline in the S&P 500 over the next several months. A 10% pullback from recent highs would take the index down to approximately 4,775. While awaiting lower entry points, 50% of my portfolio is in short-term treasuries, yielding nearly 5.4% currently. Almost all the rest are held within covered call positions, which provide downside risk mitigation. The only sector I am overweight in the market currently is energy, as I expect geopolitical pressures to continue to result in high crude oil prices.

[ad_2]

Read More: SPY: 10 Reasons To Believe A 10% Decline In The S&P 500 Is Forthcoming