SPY: The ‘Value’ From Equities Is Historically Low

[ad_1]

da-kuk

Equities have managed to bounce somewhat this week on better-than-expected Q1 results from the likes of General Motors (GM), Novartis (NVS) and other notable names after the S&P 500 (SP500, SPX) posted its worse weekly performance since March 2023 the previous week.

I still remain in the cautious camp as I don’t think investors have properly priced in the “higher for longer” scenario for interest rates as inflation has become sticky and the Federal Reserve has consistently moved back potential rate cuts throughout 2024. More importantly, the stock market is offering very little value here from a historical perspective.

One of the first things that is taught in Finance 101 is that investors hold stocks as it provides a risk premium over owning risk-free instruments such as 10-Year Treasuries. The premium that should be demanded is generally tagged at 300 to 500 basis points, depending on economic and earnings growth prospects. This includes stock dividends. So where does the current market stand?

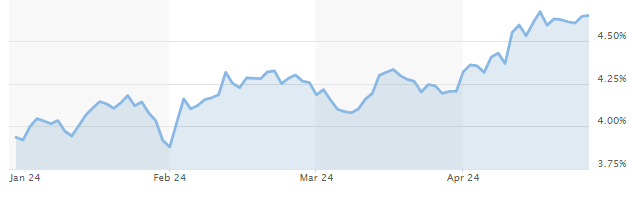

10-Year Treasury Yield (MarketWatch)

The yield on the 10-Year Treasury (US10Y) stands at 4.65%, having risen sharply from just under 3.9% at the end of January. That will be our risk-free standard. We will use the SPDR® S&P 500 ETF Trust (NYSEARCA:SPY) as our representative for the overall market. Currently, it yields just over 1.3% in dividends. This means investors should be requiring 6.35% to 8.35% from equities to be bullish. Using an inverse earnings yield, this means a market that is selling for roughly 12 to 16 times earnings would be providing the requisite risk premium to be solidly investible.

S&P 500 Trailing Earnings (MacroTrends)

Unfortunately, that is not what the current market is providing. Currently, the market is selling at just under 24 times trailing S&P 500 earnings (GAAP) or an inverse earnings yield including dividends of approximately 5.55%. This is significantly below the minimum premium investors should demand to be invested in the market from a classical finance perspective. This is one of many reasons I am bearish on the current market.

What could happen to make the market more attractive from a risk premium investment perspective?

Earnings Growth:

Higher S&P 500 earnings would obviously make the market more attractive, combined with increased dividend payouts. Assuming the dividend yield on the S&P 500 remains the same, S&P 500 earnings would have to rise approximately 50% to provide the minimum risk premium to make valuations attractive. After increasing a bit over three percent in 2023, S&P 500 profits are currently expected to grow in the low-teens in 2024. According to many investment firms, like Bank of America, AI will be a driver of that growth. If an investor is willing to accept a 200bps risk premium, including dividends, then S&P 500 earnings only have to grow less than 40% to be in the minimum risk premium threshold.

The Risk-Free Rate Falls:

A much easier way for risk premiums to get into an acceptable range would be for the yield on the “risk-free” rate to fall substantially. This is what investors were banking on at the start of the year when futures were factoring in 6–7 cuts in the Fed Funds rates starting in March. Stronger than expected economic growth and stubborner than expected inflation have continuously forced the central bank to delay their first rate cut. One or two cuts in 2024 looks like the best investors can currently expect.

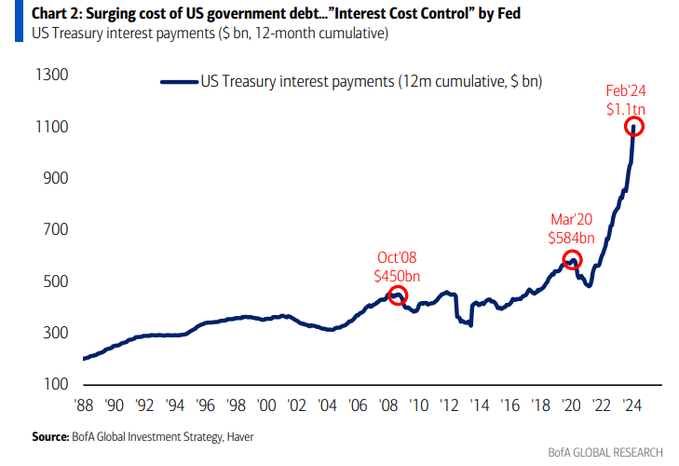

One of the main challenges in bringing down rates is massive federal government spending. The federal government ran a governmental deficit of $1.06 Trillion in the first six months of its fiscal 2024 year. Alarmingly, that is actually down from the same period a year ago. The Federal Debt has spiked by $11 trillion since 2020, and the run rate on servicing that debt is now north of $1 trillion.

BofA Global Investment Strategy

This deficit spending has been a key driver of economic growth. However, this excess money churning through the system also has been a key tailwind to inflation. Foreign central banks have eased their purchases of treasuries and are buying record amounts of gold as their belief in fiat currencies appears to be ebbing.

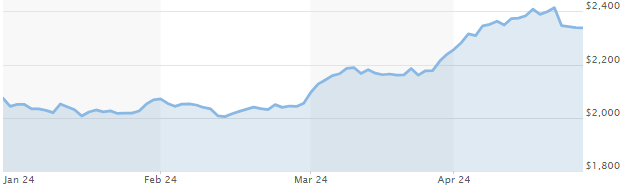

Gold per ounce (MarketWatch)

This has been a key driver of the big run-up in gold prices (XAUUSD:CUR) so far in 2024, it should be noted. Foreign entities, which include private investors and central banks, now own about 30% of all outstanding U.S. Treasury securities. This is down significantly from roughly 43% a decade ago.

To achieve a significant drop in the yield in the 10-Year Treasury, either inflation needs to come down dramatically or the federal government has to rediscover fiscal discipline in a major way. I see either event as unlikely. The third way yields could come down would be via a recession. This leads us to the third path to acceptable market risk premiums.

The Market Drops Significantly:

If equities experienced a bear market, that would quickly bring risk premiums back into an acceptable range, especially as a major drop in the market would most likely bring yields down on the 10-Year Treasuries, especially if economic growth slowed dramatically. Today’s first quarter GDP report might be a sign that may be on the horizon.

Until risk premiums become more acceptable, my portfolio will remain on a very cautious footing. Approximately half of my holdings are in short-term treasuries, yielding 5.4%. Almost all the rest is within covered call holdings around the few equities I am finding acceptable value within an overbought market.

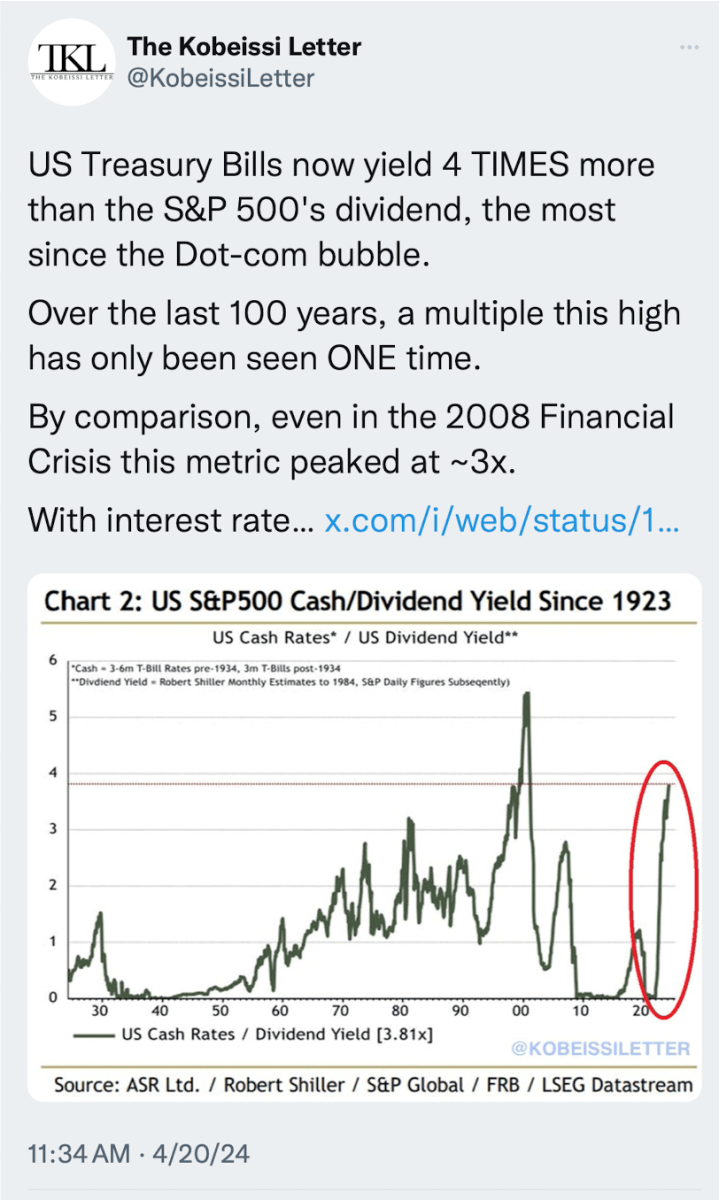

Kobeissiletter

One last data factoid. The ratio of the yield on the 3-month treasury (US3M) bill to the dividend yield on the S&P 500 is at its highest level in the past century, with one exception. That is right before the Internet Boom popped at the beginning of the 21st century. Food for thought.

[ad_2]

Read More: SPY: The ‘Value’ From Equities Is Historically Low