SPYD: A Deeply Flawed 4.81% Dividend Yielding S&P 500 ETF

[ad_1]

Galeanu Mihai/iStock via Getty Images

Investment Thesis

I previously covered the SPDR Portfolio S&P 500 High Dividend ETF (NYSEARCA:SPYD) on October 17, 2023, recommending readers avoid its attractive dividend yield and assign weight to the fund’s negative expected earnings per share growth and low dividend safety score. Today’s article aims to update readers on SPYD’s latest semi-annual reconstitution last month, which resulted in nine substitutions in this 80-stock equal-weight fund. Although this turnover isn’t huge, I regret to inform shareholders that SPYD’s fundamentals have deteriorated across the board. The ETF’s expected dividend yield declined by 0.35%, its forward price-earnings ratio is up 2.30 points, and earnings growth is still negative. There isn’t much positive to say, so I’m reiterating my “sell” rating on SPYD and will compare it fundamentally with three other higher-quality alternatives.

SPYD Strategy, Reconstitution Update

SPYD tracks the S&P 500 High Dividend Index, selecting the 80 highest-yielding dividend securities in the S&P 500 Index in equal weight. The Index reconstitutes at the end of January and July, and this time, added several REITs. In total, there were nine additions, as follows:

- Kellanova (K)

- Bristol Myers Squibb (BMY)

- United Parcel Service (UPS)

- Host Hotels & Resorts (HST)

- Extra Space Storage (EXR)

- Camden Property Trust (CPT)

- Mid-America Apartment Communities (MAA)

- WEC Energy Group (WEC)

- Exelon (EXC)

On average, these stocks trade 5.58% below their 200-day moving average prices compared to +11.56% for the SPDR S&P 500 ETF (SPY). This 17.14% sums up SPYD’s strategy, which essentially is to hold many of the worst-performing dividend stocks in the S&P 500 Index. In contrast, the eight stocks these additions replaced performed relatively well, trading 14.05% above their 200-day moving average price. They’re listed below, with the first four up 30-40% in the last six months.

- NRG Energy (NRG)

- Phillips 66 (PSX)

- Seagate Technology Holdings (STX)

- Amgen (AMGN)

- Packaging Corporation of America (PKG)

- Northern Trust (NTRS)

- Organon & Co. (OGN)

- V.F. Corp. (VFC)

Most times, price changes drive the additions and deletions. However, in VFC’s case, the reason was that the company slashed dividends by 70% in October, and their 2.16% forward dividend yield is not attractive.

Still, a key issue with SPYD’s strategy is the absence of profitability or dividend quality screens. Even in VFC’s case, shareholders relied on company management to tell us what was already evident in the financial statements. Unfortunately, that wasn’t before the stock declined 60% in 2022 and 28% in 2023, and was a member of SPYD both years.

SPYD Analysis

Using Seeking Alpha Dividend Grades

There are ways to predict whether a company will cut its dividend payments, or at minimum if it should. Seeking Alpha Dividend Grades allows readers to assess dividend yield, growth, consistency, and safety, and VFC happened to have an “F” grade in December 2022. Newell Brands (NWL) also had an “F” grade and slashed its dividend by 70% six months later.

These poor grades signified that the companies were not on strong financial footing, as the safety grade evaluates various metrics like dividend payout ratios, debt load, and profitability. To be sure, there are false positives, but it’s useful for ETF investing because as long as the number of false positives is limited, investors can use this information to their advantage. To illustrate, consider these average price returns for dividend-paying S&P 500 stocks by dividend grade since my December 12, 2022, review:

- F: -2.95%

- D: 9.84%

- C: -4.68%

- B: 4.38%

- A: 14.09%

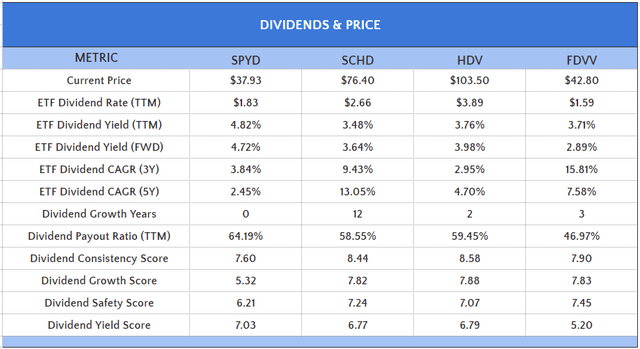

The relationship is not linear, but it suggests dividend investors should buy stocks with better dividend safety grades. We can evaluate how well SPYD does this by calculating a weighted average dividend safety score on a ten-point scale. For SPYD, it’s only 6.21/10, which is about a “B-” grade. In contrast, ETFs like the Schwab U.S. Dividend Equity ETF (SCHD), the iShares Core High Dividend ETF (HDV), and the Fidelity High Dividend ETF (FDVV) score 7.24/10, 7.07/10, and 7.45/10, respectively, which is between a “B” and a “B+.” These ETFs also outrank SPYD on dividend consistency and growth, which are important considerations if you plan on holding for the long run.

SPYD Performance Analysis

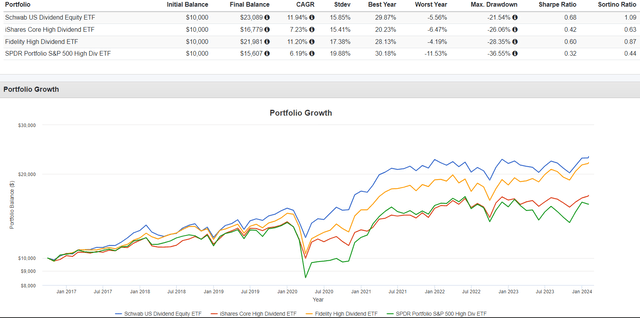

Compared to these three ETFs, SPYD’s track record is not good. Since FDVV’s inception in September 2016, SPYD has gained just 6.19% on total returns (with reinvested dividends), compared to 11.94%, 7.23%, and 11.20% for SCHD, HDV, and FDVV.

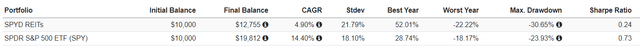

SPYD also had a substantial 36.55% drawdown in Q1 2020 and lost another 19.30% between June 2022 and October 2023, from which it has yet to recover. The high-dividend strategy without any safety guardrails doesn’t work, and I think the best investors can hope for moving forward is a minimal capital gain on top of a dividend yield that yields close to 5%.

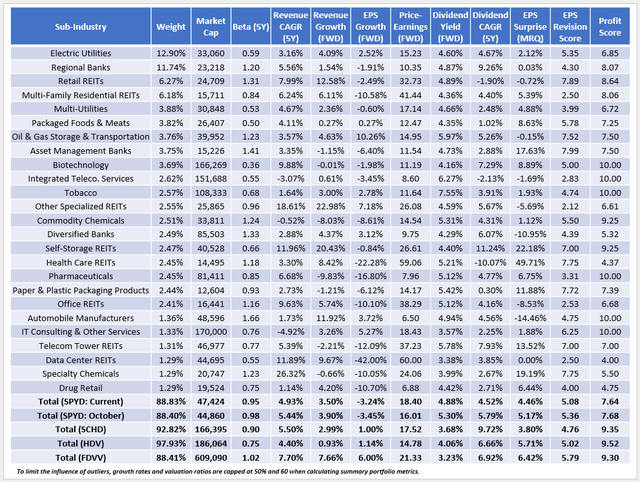

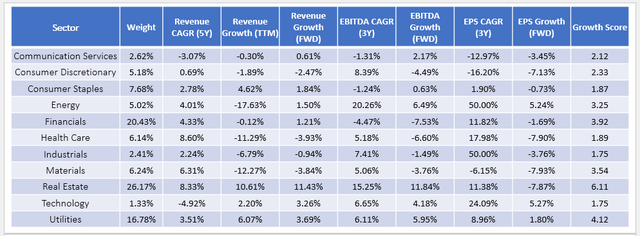

SPYD Fundamentals By Sub-Industry

A minimal capital gain is the best-case scenario because SPYD’s fundamentals continue to decline. As shown below, its estimated earnings growth rate is -3.24%, and it trades at 18.40x forward earnings, both figures worse than SCHD, HDV, and FDVV. It’s also worth pointing out that even though SPYD is equal-weighted, its top 25 sub-industries comprise 88.83% of the fund, so it’s not necessarily better-diversified than SCHD or FDVV.

Chart Source: The Sunday Investor; Data Source: Seeking Alpha

Here are three additional observations to consider:

1. High-dividend ETFs aren’t necessarily less volatile than the market. SPYD’s five-year beta is 0.95, and although it has a high allocation to Electric Utilities, it has almost 12% allocated to volatile Regional Banks and about 26% exposure to REITs. According to statistics provided by Hoya Capital, these REITs trade at a 13.2% average discount to NAV, but that’s less than the 14.2% average discount for all REITs. Furthermore, SYPD’s REITs are more volatile, with an annualized standard deviation nearly four points higher than the SPDR S&P 500 ETF over the last five years.

Given this, SPYD shareholders should consider it an above-average risk investment likely to react poorly in an economic downturn.

2. SPYD’s growth and valuation combination has deteriorated over the last 3-4 months. The table above shows an increase in forward price-earnings (16.01x to 18.40x) with no improvement in estimated earnings growth, which remains negative. Even when excluding REITs, where earnings per share isn’t the preferred metric, SPYD’s estimated earnings growth is -1.76%, with most sectors showing a drastic decline over the last five years.

Chart Source: The Sunday Investor; Data Source: Seeking Alpha

3. SPYD’s constituents yield 4.88% or 4.81% after fees, making it one of the highest-yielding U.S. equity ETFs. However, that’s down from 5.30% (5.23% net) in October, and even the constituents’ 4.52% five-year dividend growth rate looks challenging to achieve. I discussed SPYD’s poor dividend safety score earlier, but its 7.64/10 profit score is also relatively weak compared to SCHD, HDV, and FDVV.

A weak profit score often occurs with equal-weighted ETFs. Consider how SCHD’s profit score would decline from 9.35/10 to 7.58/10 if it were equal-weighted. The Invesco S&P 500 Equal Weight ETF (RSP) has an 8.41/10 profit score compared to 9.42/10 for the market-cap-weighted SPY. Sacrificing quality is the price for increased diversification, but SPYD should use some quality screens to prevent significant declines. That’s why it’s performed so poorly in bear markets and remains vulnerable today.

Investment Recommendation

SPYD reconstituted last week by adding nine stocks and removing eight. These changes were driven mainly by price performance since the previous rebalancing, as its high-yield strategy generally rotates into the worst-performing S&P 500 Index stocks every six months. However, this strategy is deeply flawed. SPYD’s dividend safety score, profit score, and estimated earnings growth are all weaker than what SCHD, HDV, and FDVV offer, and its 18.40x forward earnings valuation is not attractive either. Ultimately, it’s about chasing SPYD’s 4.81% estimated dividend yield, but I caution investors that because it’s a low-quality fund, that bet is unlikely to pay off in the long run. Therefore, I’m reiterating my “sell” rating, and I look forward to discussing this more in the comments section below. Thank you for reading.

[ad_2]

Read More: SPYD: A Deeply Flawed 4.81% Dividend Yielding S&P 500 ETF