SPY: Don’t Buy The Dip Just Yet

[ad_1]

PM Images

Throughout my coverage of the SPDR® S&P 500 ETF Trust (NYSEARCA:SPY, SP500) I consistently emphasized that my primary responsibility as an analyst was to continually give my readers fresh food for thought, avoiding direct attempts to time the market. Unlike individual companies within the ETF, which are subject to various idiosyncratic factors, SPY itself is influenced by a wide range of data inputs – therefore, it’s not only feasible but essential, in my opinion, to ensure more frequent updates.

In my latest article “SPY: The Correction May Be Massive” I wrote that even though SPY may be a good long-term investment, the growing discrepancy between real rates and the upward trend of the ETF is a huge threat. I defined “massive” as at least an 11-12% correction to the price level at the time. Since then, the ETF has only fallen -2.69%, and I can already see bullish authors talking about this dip being worth a buying opportunity. I don’t think so because the key premises that have determined the behavior of the index (not just the SPY, but the entire market as a whole) in the past are still more bearish rather than bullish. At least if we’re talking about the short to medium-term. Again, I must explain what I mean by “short to medium term.” We’re talking about a period of 3-6-12 months. I’m not trying to time the market, I’m simply talking about events that, I think, have a greater likelihood of being realized.

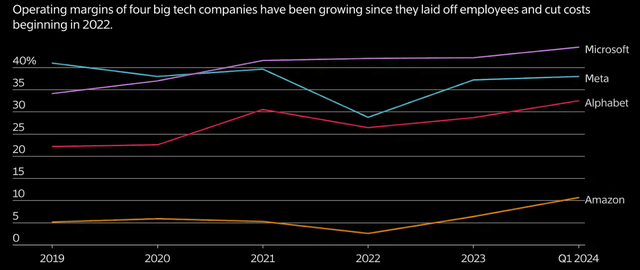

As I wrote last time, I think a lot will depend on the Fed rate in the foreseeable future. Yes, the Q1 earnings season is now in full swing with major tech companies like Microsoft (MSFT), Alphabet (GOOG), Meta Platforms (META), and Amazon (AMZN) revealing significantly improved EBIT margins compared to previous years (historically high in some cases):

The Information data, TME newsletter

And what Apple (AAPL) stock is now showing just before the opening bell is further confirmation that the market is satisfied with the strength of the major players.

Seeking Alpha, AAPL, the author’s notes

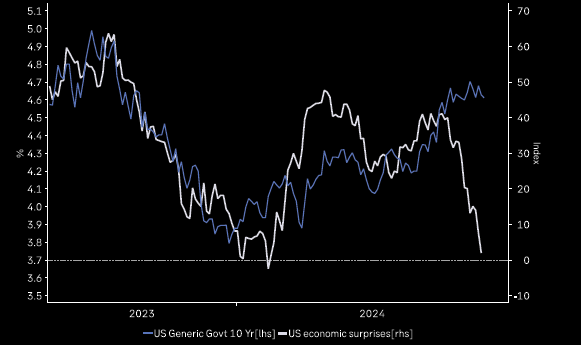

The strength of just 10 key companies is not enough – you need to look at the broader market. Judging by the surprises in the U.S. economy, the broader market (the economy) is doing well – actually “too well” considering how it has correlated with the Fed rate in the past.

Macrobond, TME’s newsletter

Here, it is important to understand what follows what: The Fed rate drives the economy, and not the other way around. Now ask yourself: Given the current strength of the U.S. economy, how can Mr. Powell cut rates when his cut will only exacerbate the situation and most likely trigger another round of inflation?

In other words, it follows that despite the Fed’s seemingly “dovish” rhetoric of late, the decision makers are unlikely to cut rates in September 2024, as many banks currently expect. A further delay in the first cut should theoretically lead to increased pressure on the capital markets, where equities are one of the riskiest asset classes.

Aside from the highly likely delay in the actual reversal of U.S. monetary policy, I’m also concerned about the outlook for the valuation of the S&P 500 in the near term. As the U.S. equity strategists at Morgan Stanley write in their latest research report (proprietary source), the significant swings in short and long-term interest rates over the last 6 months may impact equities shortly as there is a strong correlation between changes in equity multiples over a 6-month period and fluctuations in the 10 year US Treasury bond yield (US10Y).

After the sharp decline in the 10-year yield in November and December, the next 8 weeks are likely to bring a more favorable yield comparison. If current interest rate conditions persist, their analysis points to a potential ~7% decline in P/E multiples over the next 8 weeks. In addition, a gradual rise in the 10-year yield to 5 by mid-July could lead to a ~11% decline in multiples. Even if the 10-year yield were to fall to 4.25%, historical analysis still suggests modest downside potential for multiples:

Morgan Stanley report [proprietary source]![Morgan Stanley report [proprietary source]](https://static.seekingalpha.com/uploads/2024/5/3/49513514-17147141806183743.png)

On the other hand, they point out that beyond June, the pressure on valuation stemming from interest rates is expected to alleviate, assuming the observed relationship holds.

What’s noteworthy: Goldman Sachs analysts also supported this view [proprietary source], stating that they still expect Fed rate cuts in July and November, but rising UST yields could strain equities, according to their in-house models. Historically, equities struggle when yields near 5%, while “a stronger dollar (DXY) could emerge with a market favoring higher yields and lower equities.”

Goldman Sachs [proprietary source]![Goldman Sachs [proprietary source]](https://static.seekingalpha.com/uploads/2024/5/3/49513514-17147172657692928.png)

It’s worth noting that the price/earnings ratio of the S&P 500 has risen to 24.8x recently, an increase of 11.5% YoY. This is not very expensive from a historical perspective, but there is clearly room to fall if there is a reason for it. And there is such a reason, as I mentioned above.

So what do we have in essence? The U.S. economy is still too robust to consider reducing the rate (my opinion). While many banks anticipate a rate cut this year, I remain skeptical about it – I see no need to do so when the economic surprises are so solid. Moreover, the current 10-year treasury yield suggests weakness for the S&P 500’s valuation multiple. Although the big techs’ strong EBIT margins and accelerating growth rates that surpass consensus estimates may counterbalance this all to some extent and offset the decline in the multiple, in my opinion, relying on such stability alone carries significant risk given the complexity of the current macro situation.

Therefore, I remain true to my conclusions from the beginning of 2024 – investors should be constructive and not buy the dips of SPY yet, as we will most likely see a continuation of the current drawdown. But at the same time, I cannot be pessimistic as long as the economy remains as strong as it is today – that isn’t logical. That’s why I maintain my “Hold” rating on the S&P 500 Index and advocate stock selection that favors high-quality names with already stable FCF or clearer growth prospects.

Thank you for reading!

[ad_2]

Read More: SPY: Don’t Buy The Dip Just Yet