SPY vs. VOO vs. IVV: There IS A Difference Between These S&P 500 ETFs

[ad_1]

Investors love their S&P 500 ETFs. Three of the four largest ETFs in the marketplace today – the SPDR S&P 500 ETF (SPY), the iShares Core S&P 500 ETF (IVV) and the Vanguard S&P 500 ETF (VOO) – all track the biggest large-cap index. The ETF industry has taken in $644 billion year-to-date. $69 billion of that total has gone to just these three ETFs alone. It’s safe to say that investors love their S&P 500 ETFs in the core of their portfolio, although I still prefer the Vanguard Total Stock Market ETF (VTI) because it’s a little more expansive in its coverage.

It might be easy to assume that because they all track the S&P 500 and they’re so large, they’re interchangeable. For the most part, that’s true. For the average investor who just wants to have a core portfolio position in their IRA or 401(k) or whichever account they choose and wants to just hold it indefinitely, you’ll get essentially the same performance out of all three (or the differences will be razor thin at least). It’s a decision you really don’t have to (or shouldn’t) overthink.

Note: Interested in getting periodic e-mail notifications when articles are published here? Drop your e-mail in the box below!

But it’d be a mistake to say that they actually ARE identical. There will be a small subset of investors for which one of these three ETFs will be preferable over another. To find out if you’re one of those investors, it all comes down to fee structures.

SPY vs. VOO vs. IVV

There are two components to an ETF’s overall cost structure. Most people only look at a fund’s expense ratio when considering cost, but you really need to look the expense ratio and trading spread together. One is the cost of fund management and the other is the cost of trading shares. Both come directly out of your pocket.

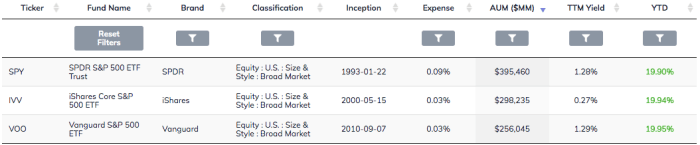

Let’s start by taking a look at just the expense ratio of all three of these ETFs side by side.

SPY is the biggest of the bunch and charges 0.09% annually (technically, it’s 0.0945% but we’ll just round it off). IVV and VOO come in much lower at just 0.03%.

In the grand scheme of things, 6 basis points per year isn’t going to move the needle in any major way. It’s a total difference of $6 a year for every $10,000 invested. Unless you’re investing hundreds of thousands of dollars or more, the difference is probably negligible. Still, if you’re starting out from scratch and trying to decide which one to open up a new retirement account with, for example, there’s no reason why you probably shouldn’t choose the lower cost VOO or IVV. After all, if you can grab a little more in total return, why wouldn’t you?

But, again, the expense ratio is only one part of the equation. In reality, your trading behavior is going to do more to influence which of these funds may be better for you than the expense ratio alone.

We’ve looked at the expense ratios. Now, let’s look at the trading spreads.

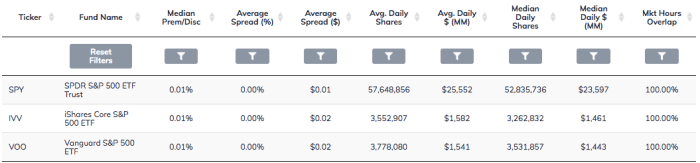

The first thing I notice when looking at this graphic isn’t the average spread. It’s the average daily volume.

IVV and VOO trade about $1.5 billion worth of shares daily. SPY trades more than $25 billion. Why such a difference? Reputation is one factor. SPY was the first ETF ever created and in the minds of investors is usually the first ticker that comes to mind when thinking of the S&P 500. It’s perhaps a minor detail, but the “SP” part of the SPY ticker also makes it easier to make the connection to the S&P 500. IVV and VOO don’t have that tie-in.

The bigger factor is liquidity. SPY is the trading vehicle of choice of big institutions. They go for SPY because it’s incredibly liquid, incredibly easy to trade and has perhaps the lowest trading cost in the industry. Really big block trades have the potential of moving the share price of smaller ETFs and that’s generally not a concern with a product like SPY.

The average trading spread rounds down to 0% for all three, but there is a difference if you look at the average cost in absolute terms. SPY costs $0.01 per share and IVV/VOO come in at $0.02. That actually makes SPY less costly to trade than the other two and why it’s the preferred ETF for large institutional traders. For the average trader, it’s immaterial (the $0.01 per share difference on a $400 share price makes no difference).

While the SPY/IVV/VOO battle is about minor differences, you can quickly see why considering trading costs in addition to expense ratios is important.

Let’s look at an example that makes the delineation a little more clear.

The newly launched Engine No. 1 Transformation 500 ETF (VOTE) is an ESG play on the large-cap universe. Setting aside the differences in targeting for the moment, we see that the fund has an expense ratio of 0.05%. That would seemingly make it a more cost-effective choice than SPY for broad large-cap coverage.

But since VOTE is such a new fund, it’s very thinly traded and that means higher trading costs. According to ETF Action, the latest spread on VOTE is 0.05%. If you’re making a single trade in VOTE and holding that position for a full year, your total cost would be 0.10% (0.05% expense ratio plus 0.05% trading spread). SPY would come in at 0.09% (0.09% expense ratio and 0.00% trading spread). Despite the higher expense ratio, SPY comes out ahead on total cost. If you plan on holding for longer than one year, the calculus changes, but you get the idea.

Conclusion

Admittedly, this exercise is kind of like splitting hairs for S&P 500 ETFs, but it’s a good exercise to go through in trying to determine how two seemingly similar funds can be a little different.

In the end, it comes down to whether or not you’re a frequent trader. If the trading spread differences are greater between two funds, going with the fund with the higher expense ratio may still make more sense than going with the cheaper ETF when trading costs are considered.

If you’re a long-term buy-and-hold investor, choosing the ETF with the lower expense ratio probably makes more sense in most cases. If you plan on trading a lot and moving in and out of positions frequently, the total cost of ownership is something you need to consider.

Note: Interested in getting periodic e-mail notifications when articles are published here? Drop your e-mail in the box below!

Also read:

2 ETFs To Consider Buying (And 1 To Avoid) This Week

The Simple 2 Vanguard ETF Portfolio That Gives You (Almost) Everything You Need

FZROX vs. VTI: Does Fidelity’s 0% Fee Total Market Fund Beat Vanguard?

ETF Battles: SOXX vs. SMH vs. XSD vs. PSI – Finding The Best Semiconductor ETF

Top Dividend Growth ETFs Ranked For The Rest Of 2021

ETF Battles: FXI vs. MCHI vs. KWEB – Which China ETF Is Best?

The 7% Yield Solution: A 4 ETF Portfolio That Offers Diversification, Risk Mitigation & High Yield

[ad_2]

Read More: SPY vs. VOO vs. IVV: There IS A Difference Between These S&P 500 ETFs