SPY: Stronger Than Ever | Seeking Alpha

[ad_1]

yorkfoto

Investment thesis

My previous bullish thesis about the SPDR S&P 500 ETF (NYSEARCA:SPY) (SP500) aged well as the broad stock market delivered a 3.5% total return over the last three months. A lot of developments have happened since February, and today I want to share why I believe that most of them were bullish signs. Despite the Fed’s tight monetary policy, it appears that corporate earnings are stronger than ever [even stronger than during the pandemic-driven frenzy]. Strong corporate performance of the U.S. business underpins the strength of the world’s largest economy. Economies of all other G20 countries are also mostly robust and recovering from the pandemic and the largest war in Europe since WWII. Overall, I remain very bullish about the U.S. stock market and stellar Q1 earnings season makes me upgrade SPY to “Strong Buy”.

Recent developments

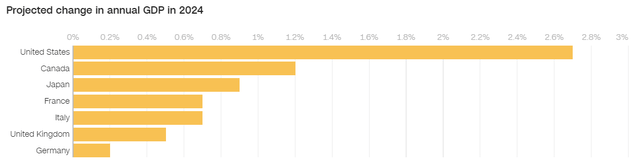

Let me start by zooming out and looking at the highest possible level, from the macroeconomic perspective. A couple of weeks ago, the IMF upgraded the U.S. economic growth forecast for 2024 significantly, from 2.1% to 2.7%. Furthermore, other G7 economies are nowhere near the pace of the projected American growth in 2024. That said, the U.S. economy remains to be the most attractive for investors compared to the rest of the developed world.

CNN based on IMF data

However, the U.S. stock market does not live in isolation and its health is also dependent on the prosperity of the global economy because American corporations sell their products and services across the world. From the perspective of the global economy, things also look good. According to the World Economic Forum, on May 2 OECD upgraded the global economic outlook to 3.1% growth rate in 2024 and rising to 3.2% in 2025. This upgrades the OECD’s previous forecasts in February for 2.9% this year and 3% the next.

OECD

That said, the resilience of the U.S. and global economies in 2024 and projected growth in 2025 are significant bullish signs for the broader U.S. stock market.

The Fed’s monetary policy is also a crucial factor affecting the stock market, and I want to share my thoughts about it as well. It is certainly that Jerome Powell and his colleagues remain more hawkish than dovish because the fight against inflation is not over yet. Indeed, from the first sight there are not many reasons for the Fed to start cutting rates: the economy is resilient, inflation is still above target levels, and the unemployment rate is close to historical lows. However, more than two years passed since the Fed started its monetary tightening cycle and as the U.S. economy continued growth, we can say that the Fed already achieved its goal of a “soft landing”, which means we are now likely to be close to the Fed’s pivot. Another positive sign is the fact that despite the March outlier, inflation still appears to be moderate even despite oil prices continue running high. Moreover, the bearish sentiment regarding Fed’s rate cuts is highly likely already priced in as financial markets now expect just one rate cut this year.

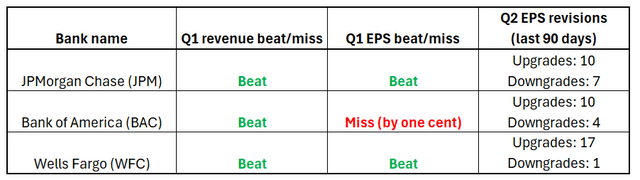

Moreover, we should not discount the fact that the U.S. corporations demonstrated strong flexibility and adaptability to the harsh monetary environment. We have an ongoing Q1 2024 earnings season and almost all financial and technological giants released their quarterly results. The season kicked off with the largest banks reporting their Q1 results, which were robust and the Q2 outlook from Wall Street analysts appear to be positive as well. Consistently strong performance of the largest three U.S. banks means that the overall corporate America is likely to be healthy.

Compiled by the author based on SA

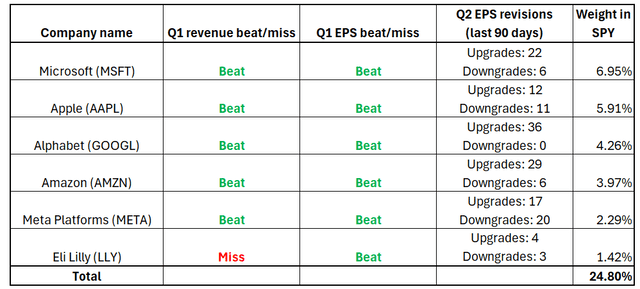

Apart from JPM, almost all other top-10 companies in the SPY portfolio also reported their Q1 earnings, and I see a lot of positive moments here as well. As shown in the below table, all the largest SPY holdings delivered positive revenue and EPS surprises against consensus estimates, except for Eli Lilly’s (LLY) actual Q1 revenue around 2% below expectations. From the below table, we can also see that Wall Street analysts’ expectations around Q2 earnings are mostly optimistic because there were much more upward EPS revisions over the last 90 days. That said, almost a quarter of SPY holdings delivered strong Q1 earnings and the Q2 outlook is quite positive.

Compiled by the author based on SA

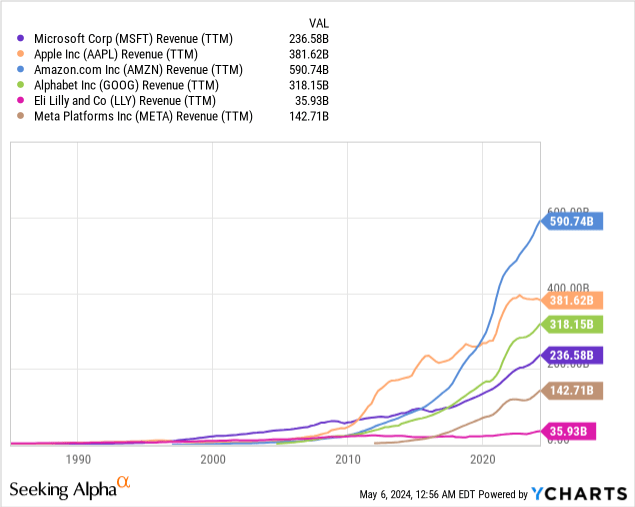

What is also crucial is that the revenues of five out of six of these largest companies are looking up. Apple’s (AAPL) revenue is an exception, but its struggles are caused by company-specific problems, in my opinion. As shown below, other giants demonstrate impressive topline performance.

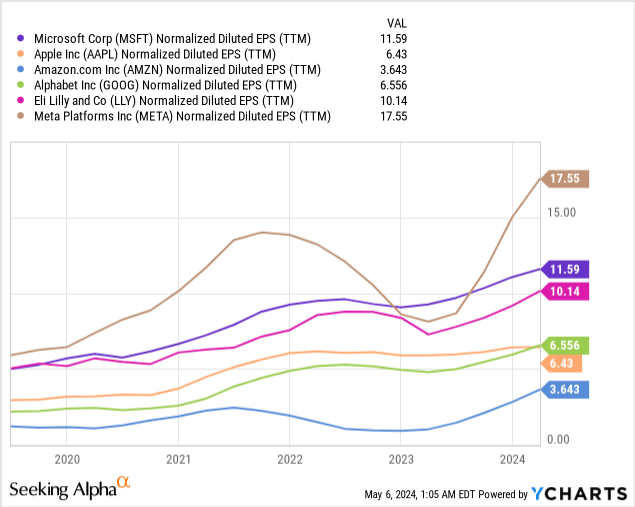

The health of corporate revenues is crucial because it appears to me that America’s largest corporations have been successful in adapting to the tight monetary environment. Profits of the largest SPY holdings appear to be at record highs, and all of them demonstrate positive TTM dynamic. It is also remarkable that EPS of giants are higher than pandemic levels when businesses navigated very favorable monetary environment. Record layoffs of 2022-2023 helped giants to improve profitability, and recent news suggests that they are still committed to cost discipline. Google (GOOG) continues cutting its headcount and moving some positions to India and Mexico, where salaries are apparently lower than in the U.S. Apple (AAPL) also announced in April that 600 more positions to be laid off. I can continue the list, and it might take much of my readers’ time, which I do not want to waste. If someone is interested, Business Insider recently summarized all notable layoffs here.

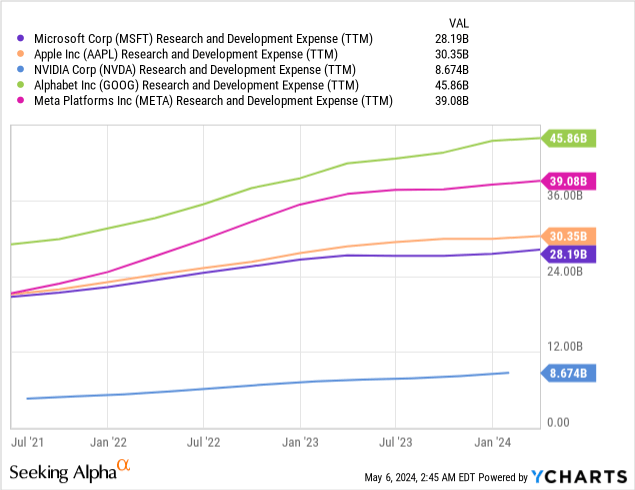

My optimism is especially strong around the largest U.S. Tech names, and it is also backed by the fact that their R&D budgets are ramping up as the Artificial Intelligence [AI] race continues. As shown below, the largest U.S. Tech companies are currently investing in R&D much more than they ever did before. This likely means that top management of these companies are quite confident in future growth and the potential to monetize new features. We all also know that all these companies are extensive ecosystems, which help create the snowball effect for their earnings once new features are released. For example, when Meta (META) introduces its new features [like a blue “verified” badge] it already has 3 billion active and loyal users and even if just a portion of them buy this new feature it already gives the company a potential to boost in financial performance. The same applies to all other largest U.S. Tech companies.

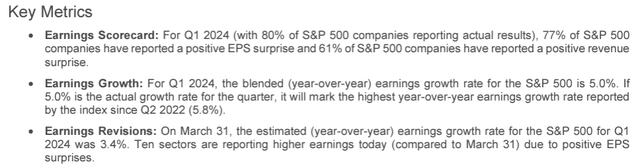

I emphasized on the strength of the largest U.S. banks and corporations because they represent the lion’s part of the SPY portfolio. However, the S&P 500 consists of hundreds of other companies, and I have to describe how their earnings season is going on as well. According to the latest “Earnings Insight” update from FactSet, 80% of S&P500 companies reported their Q1 earnings and the dynamic is quite positive. It is also crucial that eight of the eleven sectors are reporting YoY earnings growth with only Energy, Materials and Health care showing declines.

FactSet

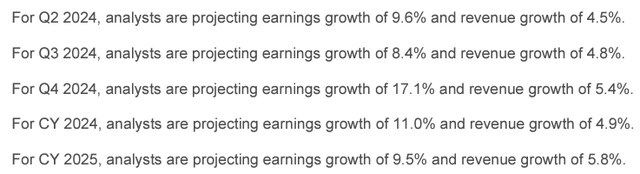

Apart from strong Q1 performance across most of the S&P 500 companies, I also must highlight that the outlook for the 2024 remained is also quite positive and FactSet expects revenue and earnings growth to accelerate in Q2-Q4. The outlook for 2025 is also positive with the projected average 5.8% revenue growth and 9.5% earnings growth.

FactSet

To summarize the fundamental part, the broad U.S. stock market is backed by rock-solid catalysts. Corporate profits continue expanding despite interest rates remaining at multidecade highs, which backs the overall health of the U.S. economy. In turn, strong U.S. economy is the cornerstone of the global economic prosperity, and this positive stance gives me high conviction in the fundamental strength of the U.S. stock market.

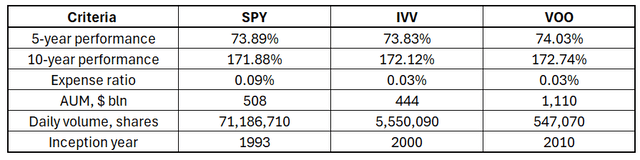

Now, let us move to specific names and tickers. I personally prefer to collect SPY in my portfolio because it is the oldest and most liquid ETF which is focused on S&P 500. It is my personal preference despite SPY having the highest among peers’ expense ratios. Investors should be aware that there are two more prominent S&P 500 ETFs, the iShares Core S&P 500 (IVV) and Vanguard’s S&P 500 ETF (VOO). These ETFs provide even slightly better long-term performance compared to SPY due to lower expense ratios. Which one to select is up to every investor’s personal priority, and liquidity matters to me.

Compiled by the author based on SA

Since all three ETFs track the same strategy, I think that my fundamental analysis of recent developments applies to all three. I consider all three of them to be a compelling investment opportunity, and SPY is the one I personally buy.

Risks update

The most important stock on Earth at the moment, NVDA, has not reported its latest quarterly results yet. The company releases its Q1 earnings on May 22 and expectations are running extremely hot with 36 EPS upgrades from Wall Street analysts over the last 90 days. Generally, I consider upward EPS revisions to be a bullish sign. However, the quantity of EPS upgrades for NVDA appears to be extremely high. Investors should keep in mind that the moon has two sides and expectations might go way higher than NVDA’s real potential to deliver positive surprise as a result of Q1. NVDA represents 5% of SPY, meaning that the exposure is limited and the direct effect of a potential sell-off in NVDA might not be significant. However, a sell-off in NVDA might lead to panic in the whole Technology sector, which currently represents 30% of the broader U.S. market.

Seeking Alpha

The political uncertainty in the U.S. is extremely high and is expected to expand as 2024 Presidential elections are approaching. I do not think that the winner of the election race will significantly affect the economic growth potential of the U.S. or will be able to affect the Fed’s decisions regarding monetary policy. However, health of the U.S. companies’ corporate profits notably depends on geopolitical relationships with China, the world’s second economy and one of the most important U.S. trade partners. Therefore, some hot headlines regarding worsening relationships between the U.S. and China might deteriorate investors’ sentiment.

Bottom line

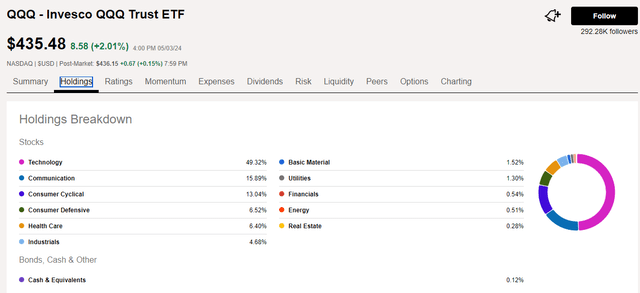

To conclude, I believe that SPY is a “Strong Buy” at the moment. The U.S. economy demonstrates rock-solid resilience, which is a big catalyst for the global economy’s health as well. America’s largest corporation continue delivering strong earnings and the outlook remains positive. Moreover, since I emphasize a lot on the largest Tech names in my article, I think that my analysis also partially applies to notable ETFs with substantial exposure to the Technology sector. One of them is Invesco’s QQQ Trust ETF (QQQ) which tracks performance of the Nasdaq index and has almost a 50% exposure to Tech stocks. QQQ is also a prominent name among all U.S. ETFs with $253 billion AUM and trading since 1999. Since it is more exposed to growth stocks, QQQ is more volatile with a 24-month beta at 1.19.

Seeking Alpha

[ad_2]

Read More: SPY: Stronger Than Ever | Seeking Alpha