SPY: Don’t Fall For The Greed

[ad_1]

patrickheagney/E+ via Getty Images

At the end of January 2024, I wrote an article entitled “SPY: Black Swan Hiding In Plain Sight“, dedicated to SPDR® S&P 500 ETF Trust (NYSEARCA:SPY). In that article, I argued that the attacks by Houthi militants on ships in the Red Sea are causing significant disruption to shipping capacity, which is driving up transportation costs and could lead to rising inflation in the foreseeable future. My recommendation was that retail investors should consider reducing their capital allocation to equities as an asset class to avoid a possible return of inflation and, therefore, a longer-than-expected period of Fed tightness so to speak. I didn’t want to time the market then, realizing that AI hype could drive the market much further than it seems possible to calculate. But today I take a much gloomier view of the stock market than I did two months ago.

It’s hard to say how much of the recent momentum in CPI can be explained by Houthi’s attacks, but inflation is actually picking up a bit before our eyes. In February 2024, the inflation rate in the US unexpectedly rose to 3.2%, beating the market consensus of 3.1%. This deviation of 0.1% seems like something insignificant. However, as BlackRock wrote in its weekly commentary, the United States may be now in a period of persistent inflation and the Fed’s 2% target is unlikely to be reached in 2025, as most market participants hope.

BlackRock, weekly commentary [March 18, 2024]![BlackRock, weekly commentary [March 18, 2024]](https://static.seekingalpha.com/uploads/2024/3/19/53838465-17108703611331773.png)

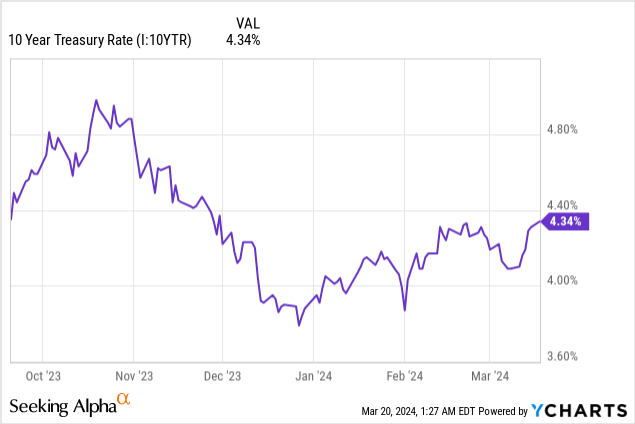

A look at the latest data on 10-year Treasury yields reveals a strong reaction in recent weeks after the inflation data once again disappointed. Since the beginning of February, yields have risen by around 34 basis points, which is quite a lot in relative terms – around +8.5% in a matter of a few weeks.

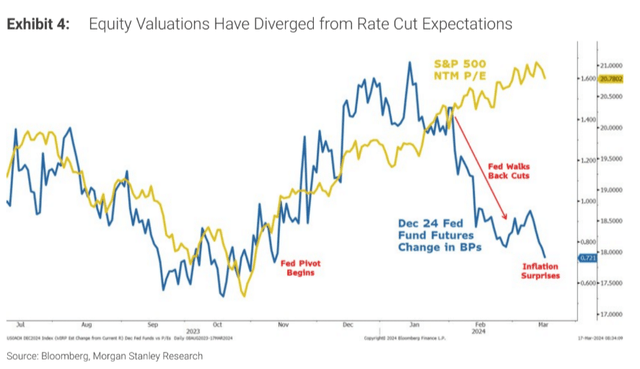

As Mike Wilson of Morgan Stanley (proprietary source) explains, this growth seems to be due to market participants moving away from the long end and the Fed walking back several of the rate cuts that had been priced in for this year. The problem for the broader equity market, however, is that we have seen no reaction to rising bond yields – market valuations have continued to edge up despite falling rate-cut expectations.

Morgan Stanley (proprietary source)

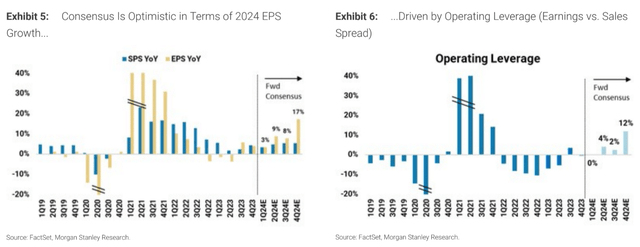

Why is there this discrepancy? It’s about the expectation of higher EPS growth throughout 2024 due to a widespread improvement in operating leverage:

Morgan Stanley (proprietary source)

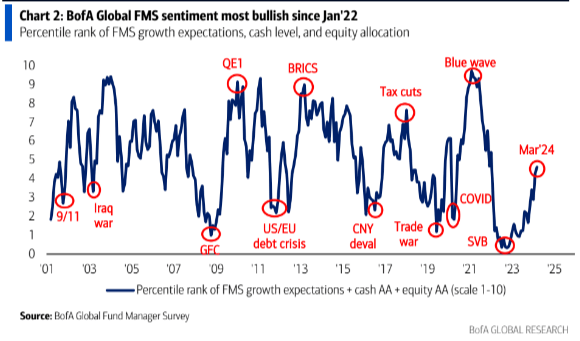

This assumption is confirmed by the latest survey data from BofA (proprietary source), which shows a sharp rise in bullish sentiment against the backdrop of the lowest number of respondents since February 2022 who expect a recession in the next 12 months.

BofA (proprietary source)

Why is this bad for future market returns?

The first problem comes from the widespread optimism about the future. At the same time, one possible reason for the slowdown in EPS growth – corporate refinancing at higher interest rates, which may remain elevated due to the risk of a continued rise in inflation – is almost completely ignored as far as I can see it.

Another problem is the limited potential for further multiple expansion. This risk factor follows directly from the widespread optimism I wrote about above. Let’s think logically. If we assume faster EPS growth for companies out of SPY, then the fund’s implied multiple starts to grow – this is what we see happening right now. Then we have 3 possibilities for the trajectory of events:

- The market surprises everyone with the strength of EPS growth. Then the analysts revise their old forecasts upwards and the high multiple stays or gets even higher if it’s not high enough by that time.

- The EPS comes to approximately the value that the market has seen it (the consensus is met so to say). The multiple will then most likely fall slightly or at best remain unchanged, without the analysts’ longer-term forecasts being adjusted in any significant way. There’s a risk in this case that we’re approaching the peak of earnings, so volatility in the markets is increasing – some are starting to “sell on facts.”

- The EPS misses the consensus view at least slightly. For many bulls, this is a sign that SPY does not deserve its elevated P/E ratio and they begin to close out their overweight long positions en masse. The market falls and the multiple is reduced to a normal level.

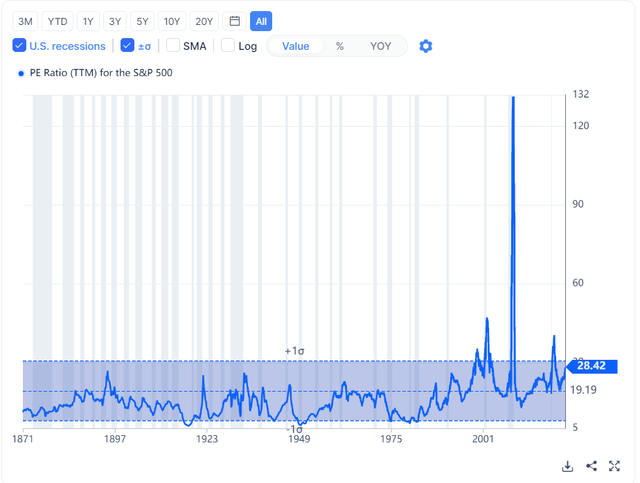

When analyzing these scenarios, as you may have noticed, a lot depends on the market multiple – in our particular case, the price/earnings ratio. The higher it is today, the more sensitive the SPY can react in each of the above scenarios. According to GuruFocus data, the current P/E ratio for the S&P 500 is 28.42x (March 18, 2024). Historically, this P/E ratio has its highest value at 131.39x (Great financial crises) and its lowest at 5.31x (seemingly about 75 years ago). The median value is 17.88x, with a typical range between 19.78x and 28.10x – so I think it is difficult to expect even greater multiple expansion from today’s ratio.

As you can see, P/E growth similar to today’s usually occurred during or immediately after crises. But COVID is long behind us, 2022 was crisis-free, and even now we are not living in a recession. Today’s P/E ratio is 1 standard deviation away from the norm, which is why I think today’s market rally is not sustainable in any of the above scenarios.

Final Thoughts

I would like to make my position clear straight away: I am not suggesting selling the SPY now or in the foreseeable future. It’s a pretty good instrument for long-term wealth accumulation that should be used as a piggy bank that you can only look into 5-10-20 years after you start investing.

I just want to convey to my readers that it doesn’t make sense to move your current (or potential) long position in SPY to “Overweight” today. First, the risk of rising inflation hasn’t gone away – that’s reflected in the rising yields in the bond market, but right now the stocks are ignoring it, waiting for salvation from EPS. Secondly, even if earnings per share come in around expected levels, there’s a risk that the valuation multiple will creep down and the S&P 500 Index will, at best, go through a prolonged period of consolidation. At worst, there could be a correction during which your money could be working for you elsewhere.

So I reaffirm my earlier “neutral” view on SPY, but this time the alarm in the back of my head is ringing louder. I beg you not to be swayed by greed (sometimes that’s necessary in the market, but obviously not today).

Good luck with your investments!

[ad_2]

Read More: SPY: Don’t Fall For The Greed