SPY And QQQ: Almost All Investors Are Crowded Into The Same Side Of The Boat

[ad_1]

jia yu/Moment via Getty Images

If everybody indexed, the only word you could use is chaos, catastrophe… The markets would fail.”

– John Bogle, May 2017

Introduction

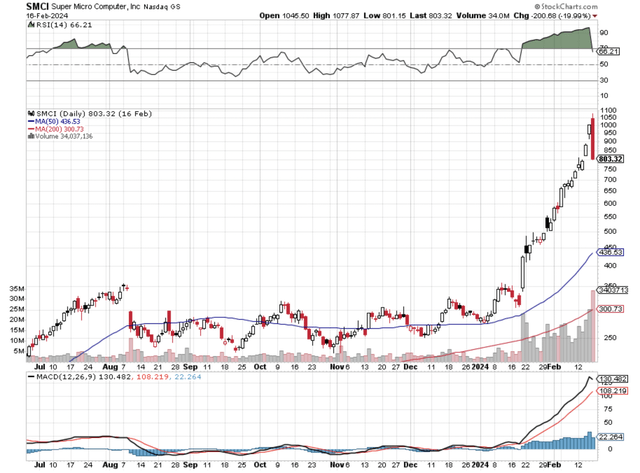

Watching the broader equity markets melt-up higher the last 16 weeks, where both the Invesco QQQ Trust (NASDAQ:QQQ) and the SPDR S&P 500 ETF (NYSEARCA:SPY) are up 14 of the last 16 weeks, and watching a stock like Super Micro Computer (SMCI) reach overbought readings that only GameStop (GME), during its epic short squeeze, has reached previously in recent memory, I am struck how much this euphoria resembles a combination of previous market episodes of market euphoria.

SMCI Daily (Author, StockCharts)

Looking at the chart above, Super Micro Computer was up 18 of the last 20 trading days before last Friday’s decline. Even with a 25% plus sell-off from its morning highs Friday, SMCI closed up 8.5% for the week.

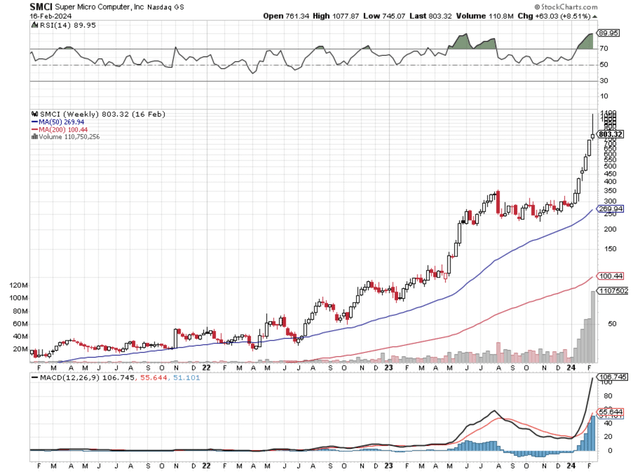

SMCI Weekly (Author, StockCharts)

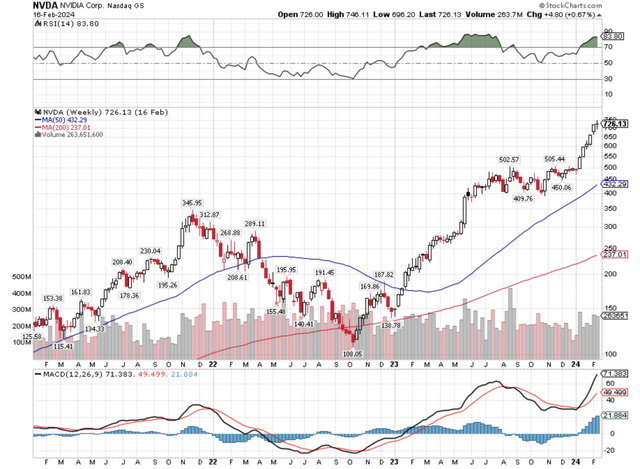

With Nvidia’s (NVDA) earnings results after the close on Wednesday, February 21st, 2024, the incredible sequences of price moves that we have seen are either set to continue into exhaustion, or the pendulum is set to swing the other way as the bar of expectations has been set too high.

NVDA Weekly (Author, StockCharts)

Either way, the magnitude of the extremes has been dictated by a strange mix of passive flows, suppressed index volatility, gamma call squeezes, and 0DTE options traders.

Said another way, in this market, momentum begets momentum, and this works in both directions.

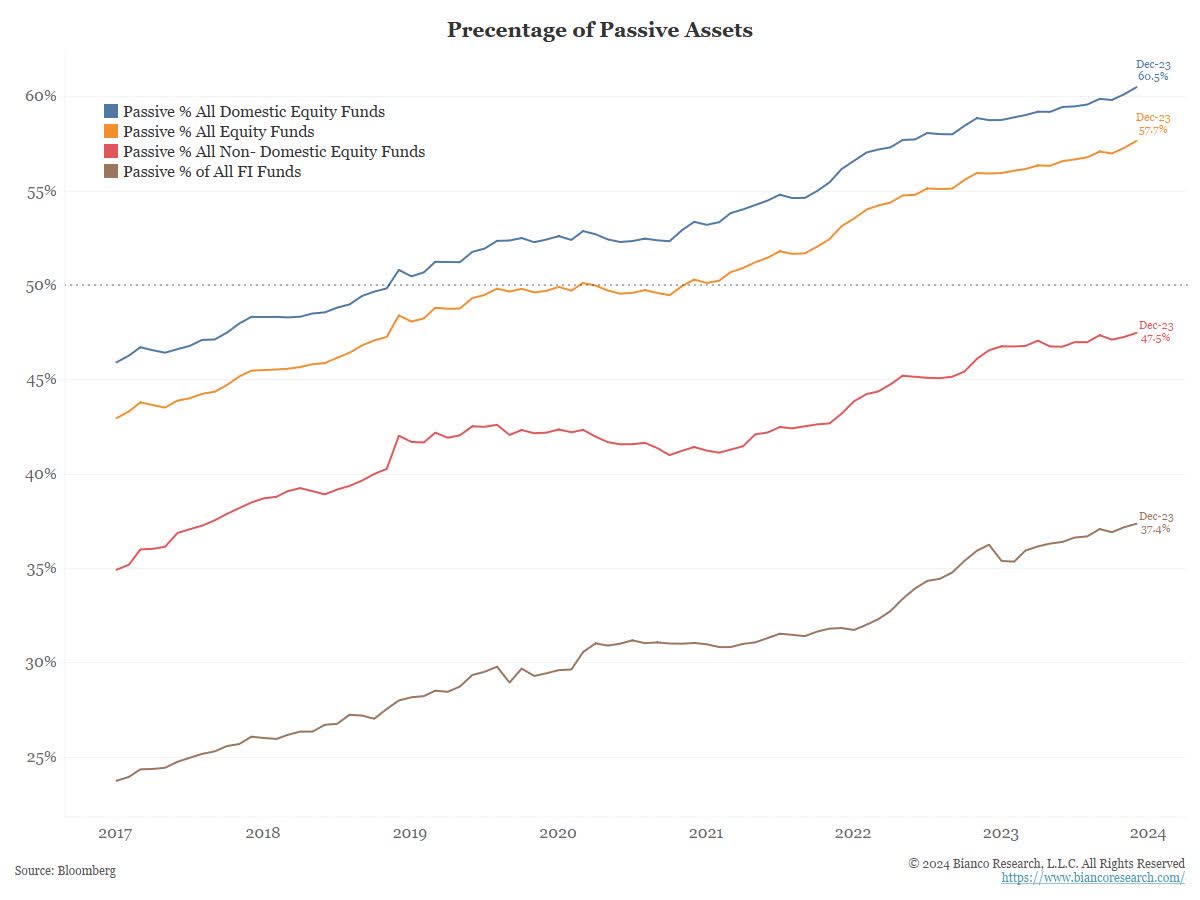

Passive Fund FlowsPassive funds now account for more than 50% of all assets, and more than 60% of domestic equity funds, according to Bloomberg and highlighted by Jim Bianco.

Passive Percentages (Bloomberg, Bianco Research)

This is actually a very conservative estimate for the following reasons.

- Many active fund managers are simply closet indexers.

- This is true for hedge funds as well, which have had their highest net equity exposure and correlation to the broader market indices in the last twenty years.

- Actual fund flows, including target retirement date funds, are a heavier percentage into passive than the total passive percentage of assets, so like a river flowing into the ocean, except the scale reversed, the end mix keeps tilting more passive.

In summary, while Jim and others say that the rubicon was passed, no pun intended, with over 50% of all assets in passively managed investments, the market has skewed passive to a greater degree for a longer time frame than many realize. Said another way, the pendulum has swung about as far as it can go in one direction, as the vast majority of fund flows are passive today, and what we are seeing with SMCI, NVDA, and other stocks, with fat tail outcomes, is simply a byproduct of momentum fund flows aided and abetted with passive fund flows.

A Repeat Of Volmageddon

The early part of February of 2018 saw an event called Volmageddon, as the following quote from Bloomberg outlines.

On Feb. 5, 2018, traders stood transfixed as the Cboe Volatility Index – a measure of expected volatility in the S&P 500 Index that is sometimes called Wall Street’s “fear gauge” – jumped by a record 20 points to a level that hadn’t been seen in years.

The Volatility Index’s sudden spike brought an end to one of the calmest chapters in U.S. equities – a years-long stretch in which equity turbulence was stuck at about half its historical average. And the episode, which would eventually be dubbed ‘Volmageddon,’ came with a messy side-effect: the collapse of one of the most pervasive and popular trades in financial market history.

Fast forward to February of 2024, and Volmageddon 2 may be on the horizon, as the sheer quantity of volatility suppression trades dwarfs what we witnessed in 2018.

All the way back one year ago in February of 2023, JPMorgan’s (JPM) Marko Kolanovic had been warning of the potential for a Volmageddon 2.0, so this has been speculating for over a year now, similar to the long lead time up to the original Volmageddon in 2018.

This is a quote from a Reuters article that frames Kolanovic’s views back then one year ago that are still valid today.

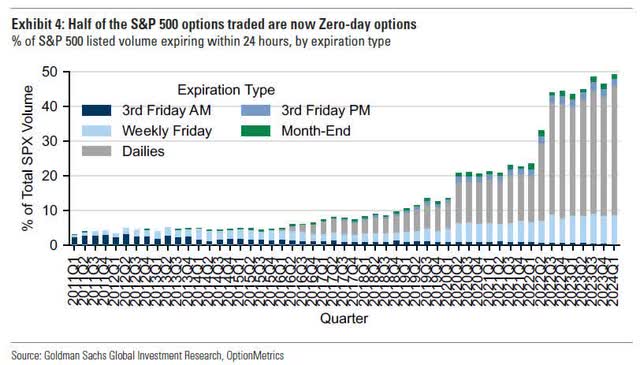

On net, these options are sold by investors taking a directional view, and have tended to suppress market volatility, JP Morgan’s Kolanovic said in a note on Wednesday.

A large intra-day move in the market, however, may result in these options sellers being forced to cover these positions all at once and spark massive volatility, Kolanovic said.

“These flows could particularly impact markets given the current low liquidity environment,” Kolanovic, who estimates that a large market move would cause these options positions to spark buying or selling to the tune of $30 billion.

Looking back to 2018, the underlying move in the broader equity markets was not that big to trigger the original Volmageddon, roughly a four percent decline in the broader markets, and given how tightly wound and orchestrated the markets are today because of the passive flows, the suppression of volatility trades, the gamma squeezes, and the 0DTE flows, it may not take that big of correction once again, to get the ball rolling in the other direction.

“Overall we feel that 0DTE poses the potential to create a flash crash at the index level,” SpotGamma founder Brent Kochuba said.

“(It) could draw large, sudden hedging requirements from options dealers. This could be particularly dangerous around an unexpected news event that catches people offsides,” Kochuba said.

Ultimately, this is an event that is hard to guard against, and hard to predict, as Kolanovic’s antenna was raised on this one year ago, and essentially, nothing happened. Rather, instead of a melt-down, we got a melt-up. However, the probability of another episode of Volamageddon happening has increased from even one-year ago, in my opinion, due again, to the combination of factors discussed in this article.

Gamma Call Squeeze Amplified

In 2020, Softbank was revealed as the whale that orchestrated a gamma call squeeze by buying massive quantities of call options on the largest technology stocks.

Snapshot Of CNBC Article (CNBC)

Fast forward roughly 3-and-a-half years later, and call option buying has continued to increase, particularly on the magnificent seven group of stocks, with option volume setting a record on February 2nd, 2024 per the WSJ.

Snapshot Of Record Call Volumes (WSJ February 2nd, 2024 Article)

Is Masayoshi Son, the head of Softbank, the whale again behind the surge in call option buying?

Possibly, however, he has been joined by a lot of cohorts, as the wave of option buying this time dwarfs what we saw in 2020. Ultimately, with the proverbial tail wagging the dog, we could find a hedge fund or family office like Archegos on the wrong side of these trades, and that could really be the first domino to fall in an unexpected volatility rise.

0DTE Options Rule The Roost & Are The X Factor

Half of all S&P 500 (SP500) options traded are now 0DTE options, defined as options that expire within 24 hours according to research from Goldman Sachs (GS).

Half Of S&P 500 Options Are Now 0DTE (Goldman Sachs, OptionMetrics)

Obviously, these have been fueling the broader equity market melt-up, however, they can, and will at some point, work both ways.

Closing Thoughts: Almost All Investors Are Crowded On The Same Side Of An Unstable Boat

A unique blend of speculation has coalesced together at the same time to propel markets higher. Passive fund flows combined with volatility suppression trades combined with gamma call squeezes combined with 0DTE options had spiraled the market higher. Adding to the narrative, futures traders are record long too.

U.S. Futures Positioning (Nomura)

When everybody is positioned on the same side of the boat, a rogue wave can send many passengers tumbling.

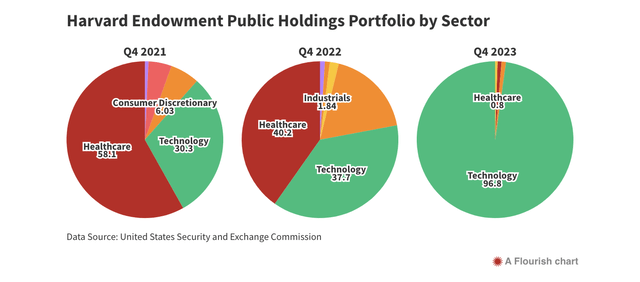

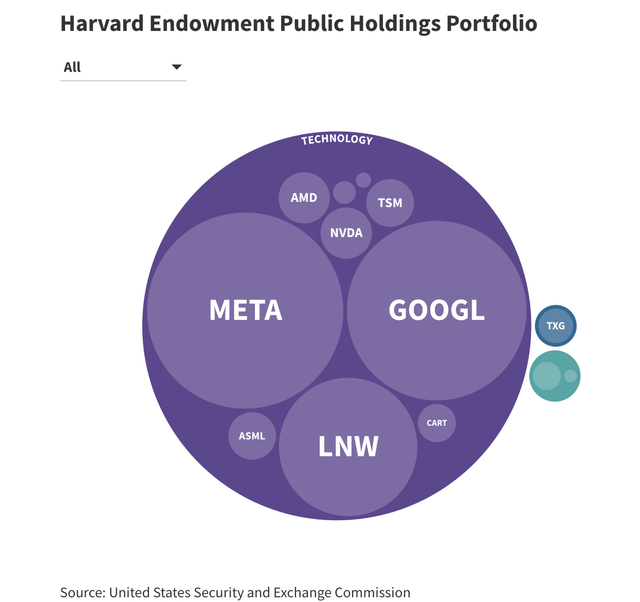

On that note, I found this interesting, specifically Harvard now has roughly 98% of their public equity portion of their endowment, admittedly a very small portion of their total endowment funds managed, in technology stocks.

Harvard Endowment Public Equity Holdings (The Harvard Crimson, SEC) Harvard Endowment Public Equity Holdings (The Harvard Crimson, SEC)

Given how large the magnificent seven are as a percentage of the U.S. stock market capitalization, it shouldn’t be a surprise that almost everybody is crowded into the same side of the boat, however, seeing the magnitude of these crowded trades in certain highlighted situations is still staggering.

Additionally, the fact that the Harvard Endowment added to their Alphabet (GOOGL) (GOOG) and Meta Systems (META) positions in the fourth quarter of 2023 is eye-opening too.

Ultimately, it is going to pay to be different, something we have seen historically in the markets at previous inflection points.

For our part, we continue to chronicle the price action since the March 2020 pandemic lows, and it is clear that energy and materials are leading the new secular bull market.

Performance Of XOP, XME, XLE, QQQ, SPY, & GDX Since The March 23rd, 2020 Lows. (Author, StockCharts)

Looking at the chart above, despite all the headlines the Invesco QQQ Trust and the SPDR S&P 500 ETF garner, they are only up 159.0% and 131.1% respectively since the broader equity market low on March 23rd, 2020.

In contrast, the much maligned energy and materials sectors are leading the new secular bull market, with the SPDR S&P Oil & Gas Exploration & Production ETF (XOP) up 362.6% over this time frame, the SPDR S&P Metals & Mining ETF (XME) up 310.3%, and the Energy Select SPDR Fund (XLE) up 299.3%.

We chronicle this on a near weekly basis with commentary in our investing group, and while we have been in a corrective stretch for much of the past two years for the energy and material equities, my expectation is that these equities will lead again, as they are still in the early innings of their new structural bull markets. After all, a stock like Nvidia, which ironically increases energy usage with its power intensive processors, eclipses the market capitalization of the entire energy and materials sector.

In closing, as Nick Saban would say, you have to love the process to get to the results. Thus, part of the beauty of what is happening in the markets today, with almost all investors crowded on one side of the boat, and a unique compilation of historical speculative excesses, all partially fueled by the passive price insensitive and valuation insensitive fund inflows, is the opportunities it is creating.

To take advantage of these opportunities, try to stay as even keeled as possible through the chaotic price action, which is easier said than done. Being a contrarian, going against the grain, is particularly important at inflection points, and we appear to be triangulated in one of those historic inflection points right now.

Best of luck to all.

[ad_2]

Read More: SPY And QQQ: Almost All Investors Are Crowded Into The Same Side Of The Boat