SPY: Ignore The Noise And Buy The Dip (SP500)

[ad_1]

78image

Introduction

The SPDR S&P 500 ETF Trust (NYSEARCA:SPY) (SP500) has tumbled in recent days after the March CPI data release, which was hotter than expected. The dip looks logical given the fact that the Fed is likely to consider inflation data to be the most important factor in respect of the next interest rate steps. The market expects at least three rate cuts in 2024, and hotter inflation might mean that the Fed will not start rate cuts soon. On the other hand, I see a few potentially strong catalysts for the stock market. That said, I do not share the market’s recent pessimism and assign SPY a “Strong Buy” rating.

Fundamental analysis

First, let me start with introducing SPY. SPDR® S&P 500 ETF Trust, or SPY, is an exchange-traded fund that tracks the performance of the S&P 500 index. That said, this ETF provides investors with exposure to the performance of the 500 largest publicly traded American companies across all sectors of the U.S. economy.

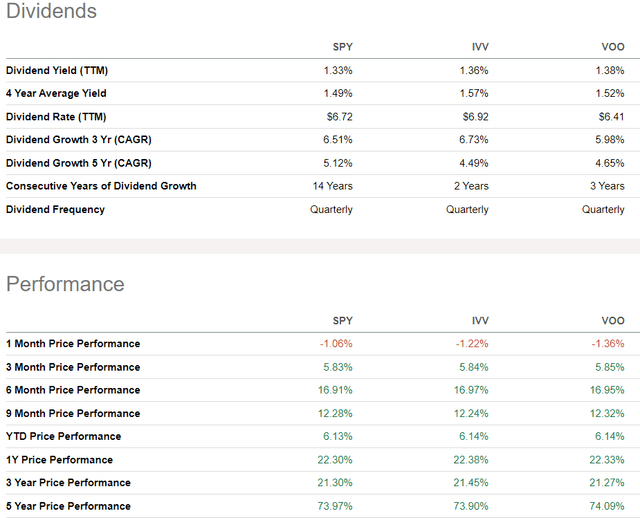

SPY is not the only ETF that tracks the performance of the S&P 500 index. There are two close rivals: iShares Core S&P 500 ETF (IVV) and Vanguard S&P 500 ETF (VOO). Despite being smaller in terms of assets under management (“AUM”) compared to VOO, SPY is far more popular, with a massive $37 billion average daily dollar volume. From the above table, we see that SPY’s daily dollar volume is more than ten times higher compared to IVV and VOO. All of the three have almost identical exposure to S&P 500, which means that the performance of all three is very close. The difference is only due to the expense ratio, which is 6 basis points higher for SPY. But the difference is marginal, and the much higher liquidity of SPY outweighs the slightly higher expense ratio. Due to the almost same exposure, dividend yield and growth records are also very close to each other.

After I described the difference between the three largest S&P 500 ETFs, I now want to explain why I am bullish about the broad U.S. stock market. As my readers know, I am an investor who believes only in fundamentals and prefer to ignore noisy and sensational headlines. As we are amid the beginning of Q1 2024 earnings season, my optimism about corporate profits is the biggest reason why I am bullish on SPY.

I have analyzed a fresh earnings insight from FactSet which has loads of interesting ideas, but I want to emphasize on the king, the EPS. FactSet’s forecast for Q1 is optimistic, with the expectation that corporate earnings are likely to increase by at least 7% YoY. Yes, the inflation is still hot, but way below the outlined by FactSet expected earnings growth. This underscores the quality of earnings growth, meaning that highly likely growth will not be just nominal, but real.

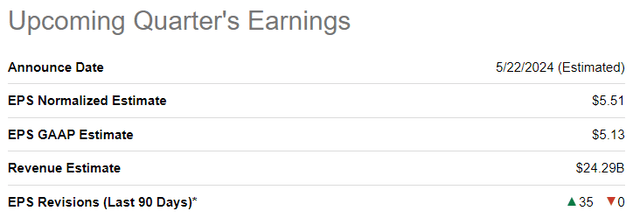

The monetary policy is still tight and there is little certainty when the Fed will start easing it. But it appears to me that businesses adapted rapidly to the tight monetary environment, as the previous two quarters also demonstrated S&P 500 earnings growth. This looks sound to me because we saw massive layoffs in 2023-2024 in the Technology sector (almost 31% of the total S&P 500 market cap is represented by this sector), which helped to boost profits. The fact that almost a third of the whole index is represented by Technology is also crucial because we are currently in the middle of a big technological revolution as the U.S. the largest corporations are fighting fiercely to leverage the most enhanced and comprehensive artificial intelligence (“AI”) solutions. Despite a lot of skepticism, AI does not appear to be a bubble to me because it is expected to add trillions to the global economy. The “most important company on Earth”, NVIDIA (NVDA), is expected to deliver a staggering fivefold increase in EPS, from $1.09 to $5.51. There were 35 EPS upgrades in the last three months, meaning that the optimism around NVDA’s earnings cannot be overestimated.

Last but not least, the earnings season has already commenced, with the largest U.S. banks starting reporting last week. Looking at the banks’ earnings is crucial to me because they represent the overall health of the corporate America. According to Seeking Alpha, all the financial heavyweights that reported last week, delivered confident beat on both top line and bottom-line estimates. Yesterday, April 15, Goldman Sachs (GS) released strong Q1 earnings.

Mitigating factors

The market might look overvalued from the P/E ratio perspective. The forward 12-months P/E ratio is above both 5- and 10-year averages, which might mean that a further drawdown towards historical levels might occur. And this actually might be the case, but I think that this scenario is unlikely. I think so because comparing the current P/E to previous years’ long-term averages would not be fair. As I mentioned before, we are amid the new wave of digital revolution, and it will highly likely add trillions of dollars of economic value over the long term. That is, the largest U.S. companies’ ability to monetize new features or enjoy cost efficiency by leveraging AI today should not be compared to five or ten years ago.

As we saw in recent days, there is a probability that the U.S. might be involved in a possible military conflict between Israel and Iran. Frankly speaking, the U.S. is already involved in this conflict since its planes and missiles helped to protect Israel from Iran’s drones. It is unlikely that Iran will escalate against the world’s most powerful military, but loads of events which happened in recent years were impossible to imagine in 2019: the global lockdown, the biggest war in the middle of Europe since World War II, the big rebellion in Russia which almost succeeded. That said, while I consider the probability of the direct military conflict between the U.S. and Iran (a country possessing nuclear weapons) very low, the potential impact might raise huge panic in the stock market.

Conclusion

My optimism around the Q1 2024 earnings season is backed by sound insights from FactSet and the solid start of the largest U.S. banks, which is an indicator of the overall strength of corporate America. I think that the digital revolution we are currently evidencing has the potential to continue boosting profits of the largest U.S. companies. Therefore, I believe that SPY is a “Strong Buy” after the recent dip.

[ad_2]

Read More: SPY: Ignore The Noise And Buy The Dip (SP500)