United Homes Group: Housing Market Improves, But Not Enough (NASDAQ:UHG)

[ad_1]

Ariel Skelley/DigitalVision via Getty Images

Since I last wrote about the house builder United Homes Group (NASDAQ:UHG) in December, its price is down by 12.3%. Even at the time, the risks to the company were clear, prompting a Hold rating on the stock. Not the least of these risks was the state of the housing market, with high-interest rates pricing out prospective buyers.

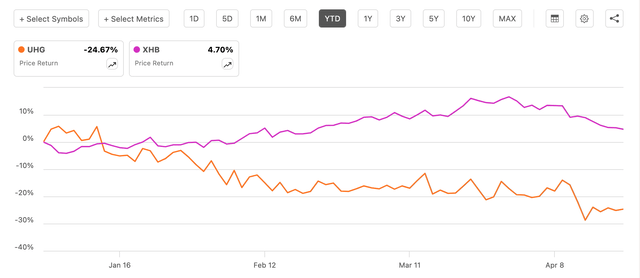

However, even at that time, the broader housing market was seeing an uptick. This is evident from the performance of the SPDR S&P Homebuilders ETF (XHB). The trend continues, increasing the gap between the performance of UHG and the sector (see chart below).

This suggests that there’s more going on here than just the market conditions. Here, I take a closer look at why UHG is underperforming and whether there’s any possibility of a turnaround in the foreseeable future.

United Homes Group and SPDR S&P Homebuilders ETF, Price Returns, YTD (Source: Seeking Alpha)

Improved housing market conditions

One big reason for the stock’s underperformance when I last checked was its weak fundamentals. The company’s revenues had dropped by 15.8% year-on-year (YoY) in the first nine months of the year (9m 2023) and the operating margin had seen a sharp decline on higher operating expenses too.

But things are changing, at least on the revenue front. Recovery in the housing market is beginning to show up for UHG, which saw a small 1.5% year-on-year (YoY) increase in revenues in the final quarter (Q4 2023) in contrast to an 11.6% decline for the full year 2023.

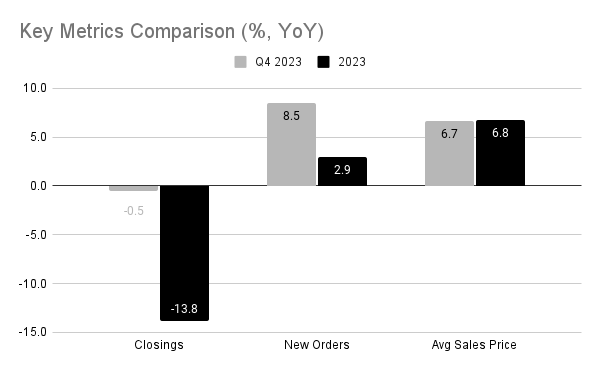

While the change in average selling price is almost the same in both Q4 2023 and the full year 2023, the final quarter’s revenue turned out better as home closings stayed essentially flat, an improvement from the full year and new home orders’ growth accelerated (see chart below).

Key Housing Metrics (Source: United Homes Group, Author’s Estimates)

Profits weaken in Q4 2023

The gross profit margin at 18.5% for Q4 2023 was slightly lower than the 19% for 2023 as the cost of sales inched up a bit compared to a contraction for the full year. But the change isn’t big enough to be any source of concern.

The operating margin dropped too, to 2.7% in Q4 2023, compared to 3.5% for the full year 2023. This was partly due to a USD 1.8 million increase in operating expenses on account of share-based compensation and transaction expenses. However, even excluding these exceptional expenses, the total operating expenses were up by 54% compared to 31% for the full year.

A change in the fair value of derivative liabilities resulted in a net loss in Q4 2023, even as the net income for 2023 rose by 80% on a corresponding massive increase in the fair value of liabilities. Notably, as a result, the net margin for 2023 rose to 29.5% compared to the already healthy 14.6% in 2022.

2024 begins well, positive housing market outlook

2024 has started well for UHG. The company continues its inorganic expansion with the buyout of Creekside Custom Homes for USD 16.9 million after it made two acquisitions last year. This latest acquisition expands its footprint in South Carolina after it purchased Rosewood Communities last year, which is in the same market.

In terms of organic growth, too, the company has also had a good start to 2024, with another 7.4% YoY rise in new orders in January-February. With the housing market also looking better, this may well continue. According to Freddie Mac “upward home price pressure” can be expected this year, though it expects just a 0.5% increase in prices in 2024 and 2025. Nevertheless, this is an improvement after a 13% YoY drop in the average house price at the end of 2023.

Moreover, with a 5.9% YoY increase in new home sales in February 2024, the relevant category for UHG, compared to the 3.3% decline in existing home sales, chances are that the average selling price for the company can continue to see an uptick if the trend continues, as was already visible last year.

Elevated market multiples

The sharp bump up in net income has reduced the trailing twelve-month [TTM] price-to-earnings (P/E) ratio to just 2.5x, which is very low by any standard. But since the profit rise is only due to accounting differences, I calculated the net income excluding the change in fair value of derivative liabilities too. This results in a far higher P/E of 33.5x.

This adjusted P/E is far in excess of that for peers of a similar market capitalisation like Beazer Homes (BZH), with a presence across US states and manufactured, tiny and mobile homes provider Legacy Housing Corporation (LEGH) at 5.2x and 9.2x respectively.

To keep the analysis consistent from last time, I also compared UHG’s EV/EBIT. First, at 27.6x, it’s far higher than the 12.9x level it was at the last I checked. Second, it’s also far higher than that for peers. While BZH trades at 9.9x, LEGH is at 7.9x. Even if the expenses for share-based compensation and transaction expenses are added back into operating income, the adjusted EV/EBIT at 24.6x is still far higher compared to peers.

The key point here is that no matter how we look at the market multiples, they just don’t look competitive unless of course the reported earnings figure is considered for 2023. This is although UHG’s price has deteriorated in the meantime.

What next?

Going by the company’s bettering revenue performance and the improved outlook for the US housing market, the stock does look more promising. It might even be a good idea to have it on the investing watchlist.

But its price is still too high compared to adjusted profit figures, even after it has seen a price drop in the past months, which is in any case at odds with housing stocks. If the company’s first-quarter numbers, due next month, show a pickup in profits or if the price corrects appreciably, there can be a stronger Buy case for UHG. But right now, it remains a Hold.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

[ad_2]

Read More: United Homes Group: Housing Market Improves, But Not Enough (NASDAQ:UHG)